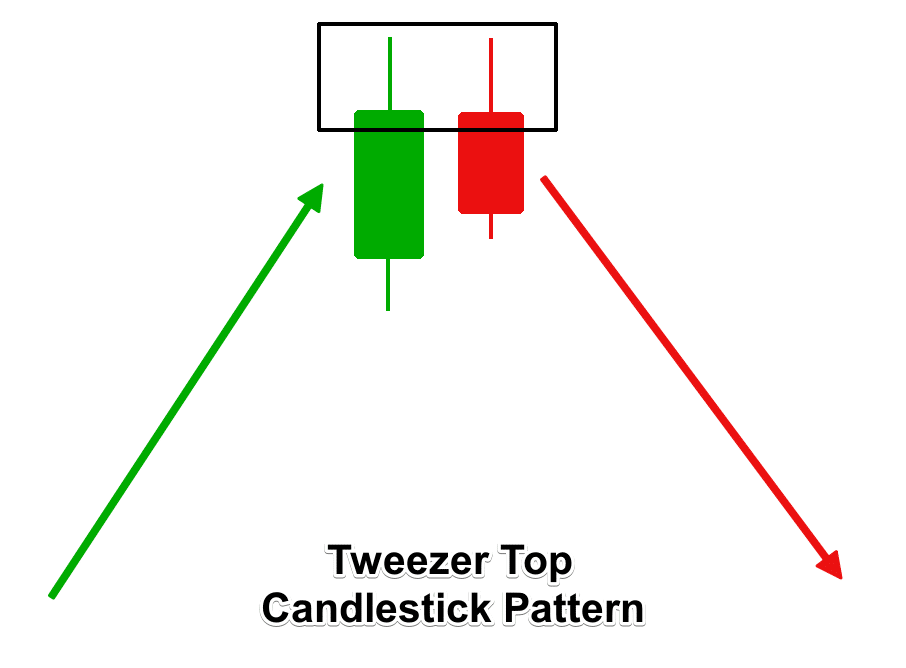

It occurs during an uptrend when buyers attempt to push prices higher but cannot do so, frequently ending the session near the session tops. Web want to spruce up the feel of your wardrobe? It is classified as a bearish reversal chart pattern. It consists of two candlesticks, the first one being bullish and the second one being bearish candlestick. Third, those candles must reach the same high point.

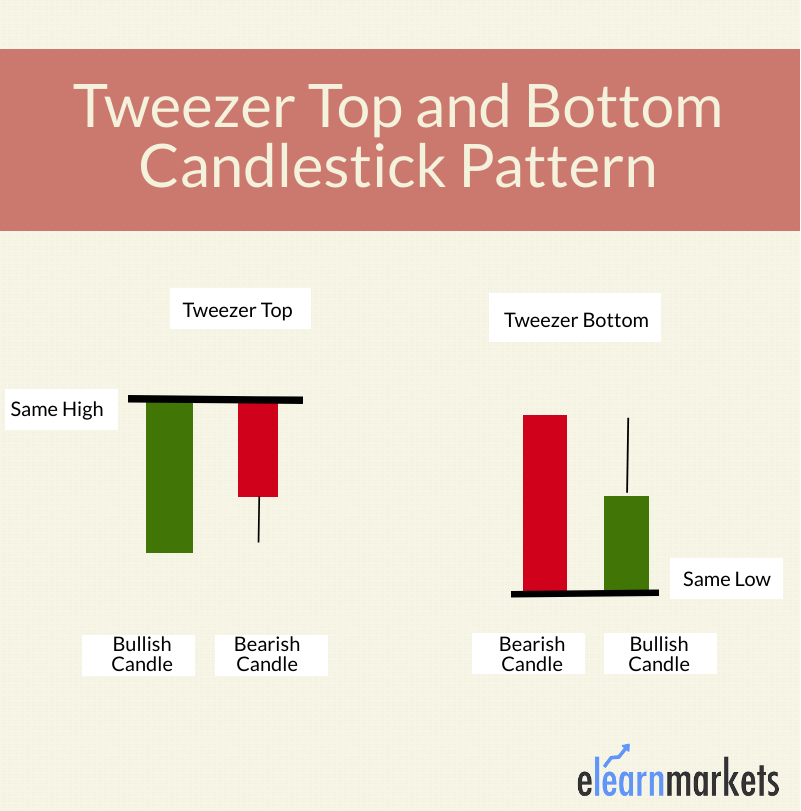

Both formations consist of two candles that occur at the end of a trend, which is in its dying stages. It consists of two candles, where the first is bullish, followed by a bearish or bullish candle with the same high as the previous bar. Web what is the tweezer top pattern? Web a tweezer top is a bearish reversal pattern seen at the top of uptrends and consists of two japanese candlesticks with matching tops. Web tweezer top and bottom, also known as tweezers, are reversal candlestick patterns that signal a potential change in the price direction.

Usually, it appears after a price move to the upside and shows rejection from higher prices. Web tweezer top candlestick pattern. In terms of location, there are two types of tweezers: That’s all there is to it! Unlike the bullish tweezer bottom, the tweezer top formation’s first candlestick shows a potential bullish trend that tops out without a wick.

The tweezer top pattern is a bearish reversal candlestick pattern that is formed at the end of an uptrend. It means that there is powerful support or resistance line. The tweezers top patterns are bearish, and the tweezers bottom are bullish. Web want to spruce up the feel of your wardrobe? Web wrap top sewing pattern roundup. Web the tweezer pattern is a double candlestick pattern that should appear in an existing trend. This pattern signals a potential reversal of the trend to the downside. The matching tops are usually composed of shadows (or wicks) but can be the candle’s bodies as well. Web hartung et al. Both formations consist of two candles that occur at the end of a trend, which is in its dying stages. Web what is a tweezer top candlestick? Web the tweezer top pattern is a two candle formation. These patterns occur after an uptrend or downtrend and signal that the current trend may be weakening. The tweezer top candlestick is a bearish pattern made of two candlesticks in a chart. Web what is the tweezer top pattern?

Web Tweezer Top And Bottom, Also Known As Tweezers, Are Reversal Candlestick Patterns That Signal A Potential Change In The Price Direction.

The tweezers top patterns are bearish, and the tweezers bottom are bullish. Web the tweezer top pattern is a two candle formation. Demonstrate the ability to load rubidium atoms into an optical lattice placed in an optical cavity. A tweezers top is when two candles occur back to back with very similar highs.

That’s All There Is To It!

To identify this bearish candlestick pattern, you’ll need to spot the following (very flexible) criteria: Trading the tweezer top is simple. It consists of two candles, where the first is bullish, followed by a bearish or bullish candle with the same high as the previous bar. Web july 12, 2024 / 4:08 pm edt / cbs news.

Find 20 Free Wrap Top Patterns That Are Easy To Sew A Wrap Top For Your Wardrobe.

Web wrap top sewing pattern roundup. In terms of location, there are two types of tweezers: The tweezer top candlestick is a bearish pattern made of two candlesticks in a chart. In this article, we will delve into the details of these patterns, understand their formation, and explore their application in trading strategies.

It Means That There Is Powerful Support Or Resistance Line.

This pattern signals a potential reversal of the trend to the downside. Usually, it appears after a price move to the upside and shows rejection from higher prices. A tweezer top pattern forms when two or more consecutive candlesticks have the same high price,. Web the tweezer top pattern is defined as a bearish reversal pattern.