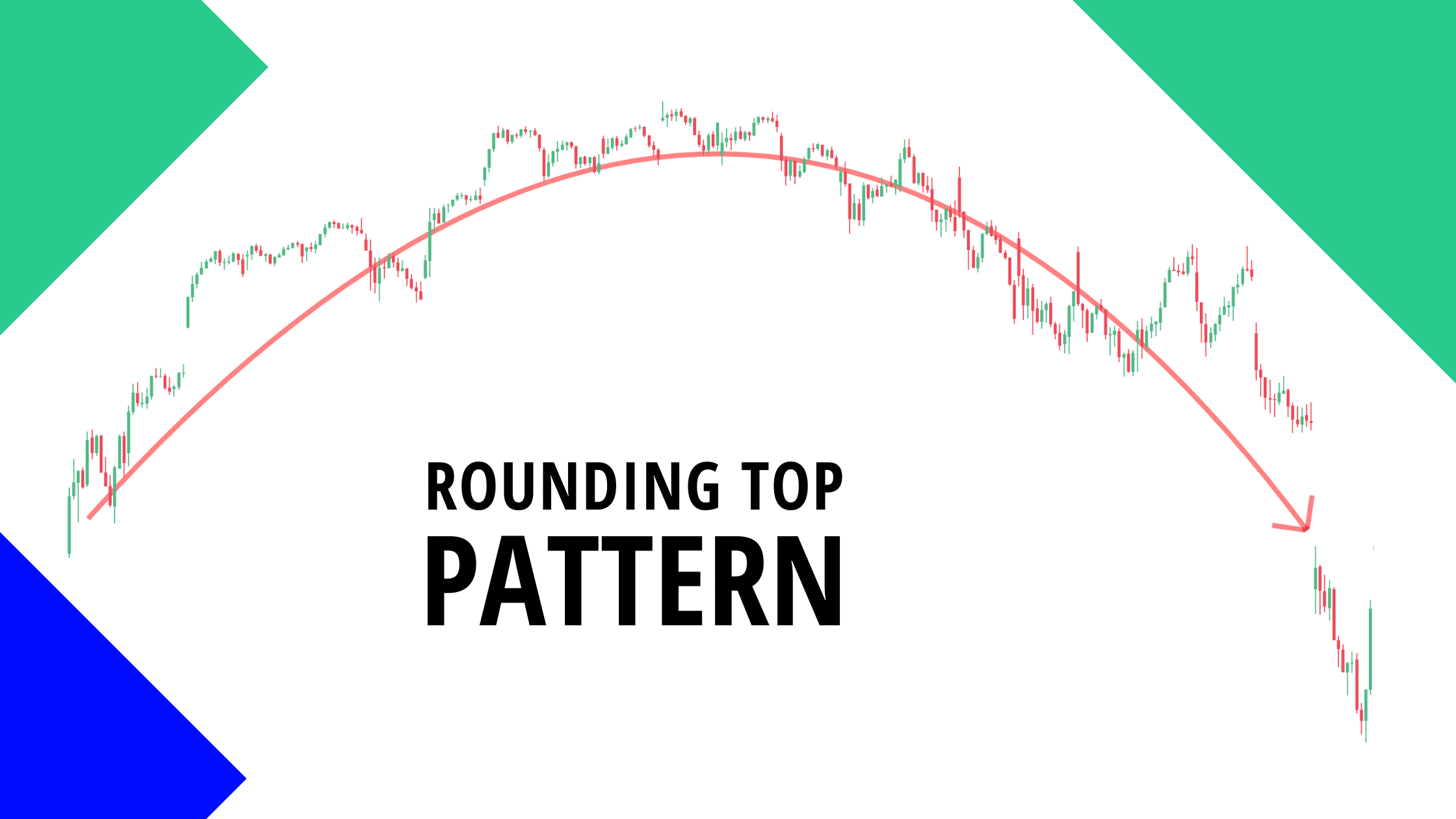

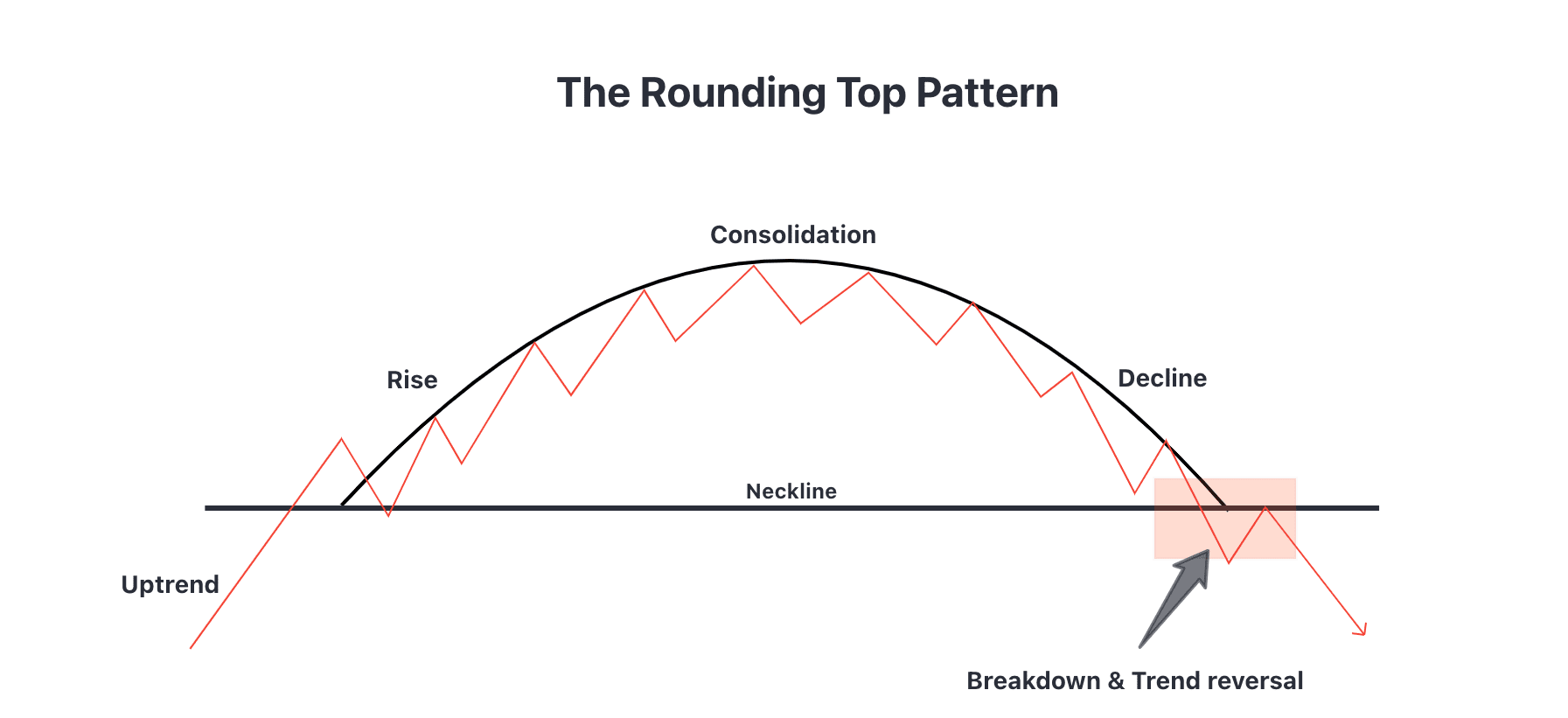

Rounding bottoms form an inverted ‘u’ shape and indicate the end of an uptrend while rounding tops appear as a clear ‘u’ formation and signal the end of a downtrend. This formation occurs after an uptrend and is typically characterized by diminishing buying pressure as the security approaches its resistance level. • rounding top pattern occur at the end of long uptrends and indicate a potential reversal. • a rounding bottom is a bearish reversal pattern that resembles the shape of the inverted u. This means that the presence of the pattern indicates there is a likelihood that the market will reverse lower, offering selling opportunities for traders.

Rounding bottoms form an inverted ‘u’ shape and indicate the end of an uptrend while rounding tops appear as a clear ‘u’ formation and signal the end of a downtrend. It denotes the stop of an uptrend and the likely start of a downtrend. Web the rounded top and bottom are reversal patterns designed to catch the end of a trend and signal a potential reversal point on a price chart. Web in technical analysis, a rounding top pattern, also known a a rounded top, is a bearish reversal price pattern that forms at the end of a bullish uptrend. • a rounding top is a chart pattern that graphically forms the shape of an inverted u.

The result is typically a slow reversal in the direction of price, creating a “u” shape that looks much like a rounded hill. It is calculated by measuring the depth of the u and then plotting that on the neck line. • rounding top pattern occur at the end of long uptrends and indicate a potential reversal. Web a rounding top is a price pattern used in technical analysis. The rounding top pattern typically forms after a sustained uptrend in the price of an asset.

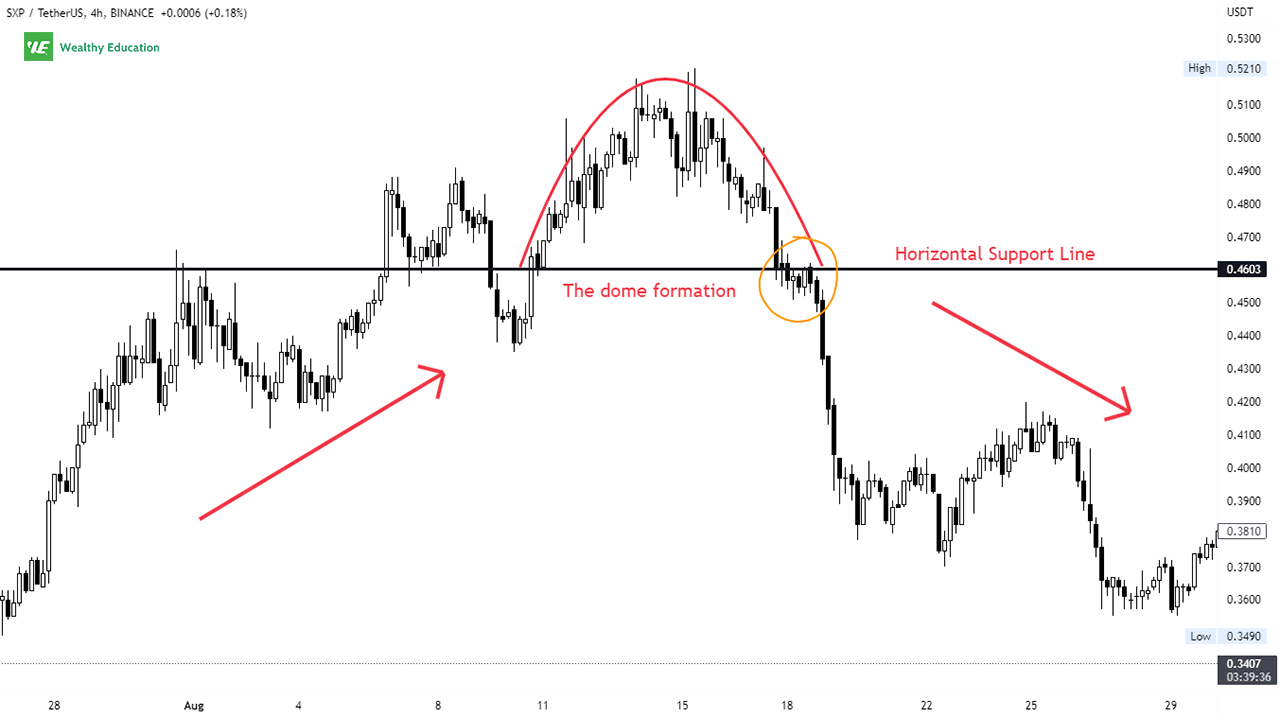

It is also referred to as “inverse saucer” as it looks similar to an inverted “u” shape. Web a rounding top pattern is a bearish reversal structure forming at the end of an uptrend. Web the rounded top are reversal patterns used to signal the end of a trend. Web a rounding top is a price pattern used in technical analysis. Read for performance statistics, trading tactics, id guidelines and more. Written by internationally known author and trader thomas bulkowski. The rounded top pattern appears as an inverted 'u' shape and is often referred to as an ‘inverse saucer’. Web a rounding top is a bearish reversal pattern that resembles the shape of an inverted “u” and signals a potential shift in market sentiment. Web one type of chart pattern that is often used to identify potential reversal points on a price chart is the rounding bottom or top. Web what is a rounding top? Here's a detailed explanation of what a rounding top pattern indicates: Special agent, said the image captured by doug mills, a new york times photographer, seems to show a bullet streaking past former president donald j. • a rounding bottom is a bearish reversal pattern that resembles the shape of the inverted u. Web in technical analysis, a rounding top pattern, also known a a rounded top, is a bearish reversal price pattern that forms at the end of a bullish uptrend. • rounding top pattern occur at the end of long uptrends and indicate a potential reversal.

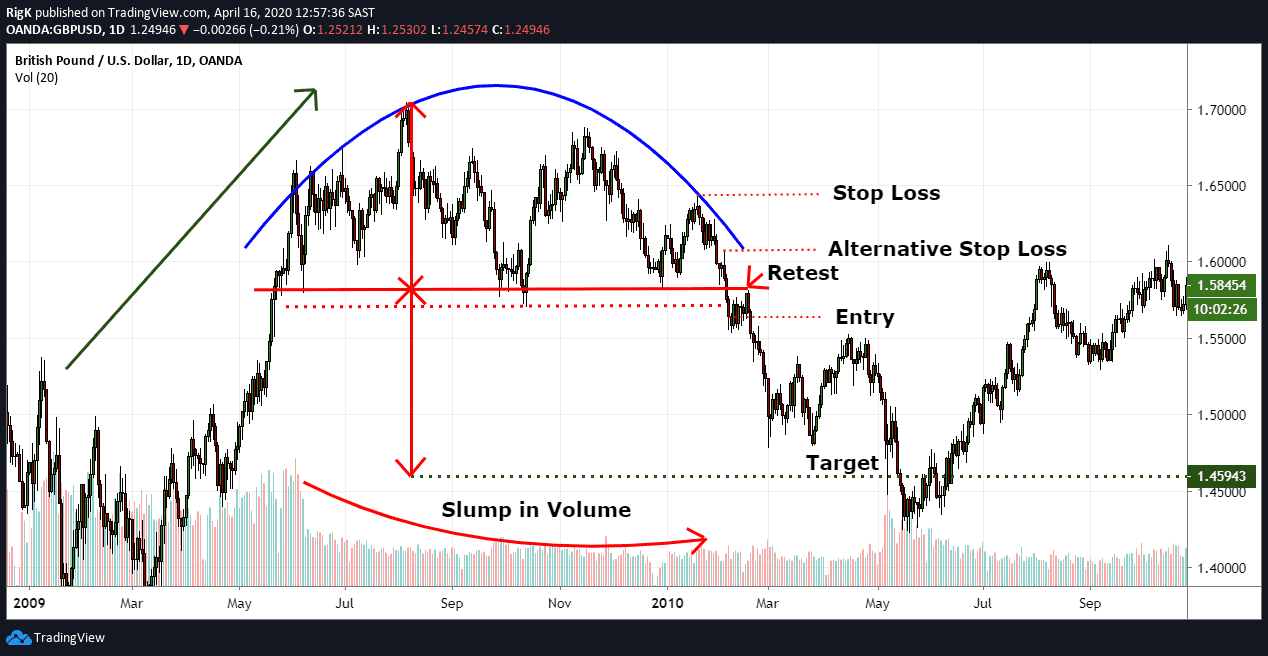

It Is Calculated By Measuring The Depth Of The U And Then Plotting That On The Neck Line.

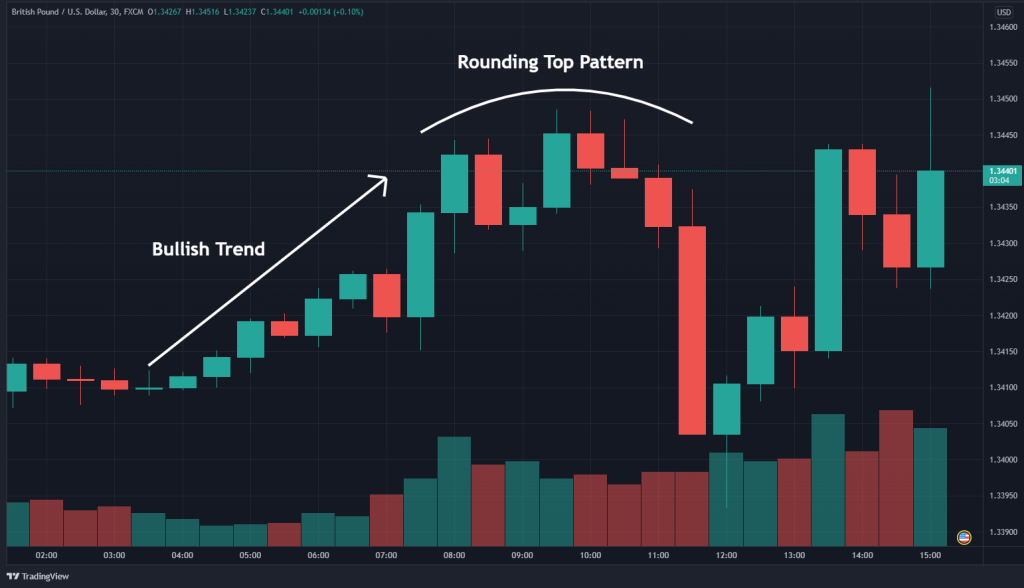

Web the rounding top pattern is characterized by a gradual curve in the price action that looks like a rounded top, hence the name. The rounded bullish peaks mark the end of. Rounding tops are usually formed at the end of the extended uptrend, indicating early signs of a possible reversal. The rounded top pattern appears as an inverted 'u' shape and is often referred to as an ‘inverse saucer’.

The Pattern Is Often Seen As A Potential Reversal Signal, As It Indicates That Buying Pressure Is Gradually Being Replaced By Selling Pressure Resulting In A Bearish Trend.

Web in technical analysis, a rounding top pattern, also known a a rounded top, is a bearish reversal price pattern that forms at the end of a bullish uptrend. Web rounding tops are large chart patterns that are an inverted bowl shape. Written by internationally known author and trader thomas bulkowski. Observe an extended period of stalled price action.

Follow The Steps Below To Distinguish The Rounding Top:

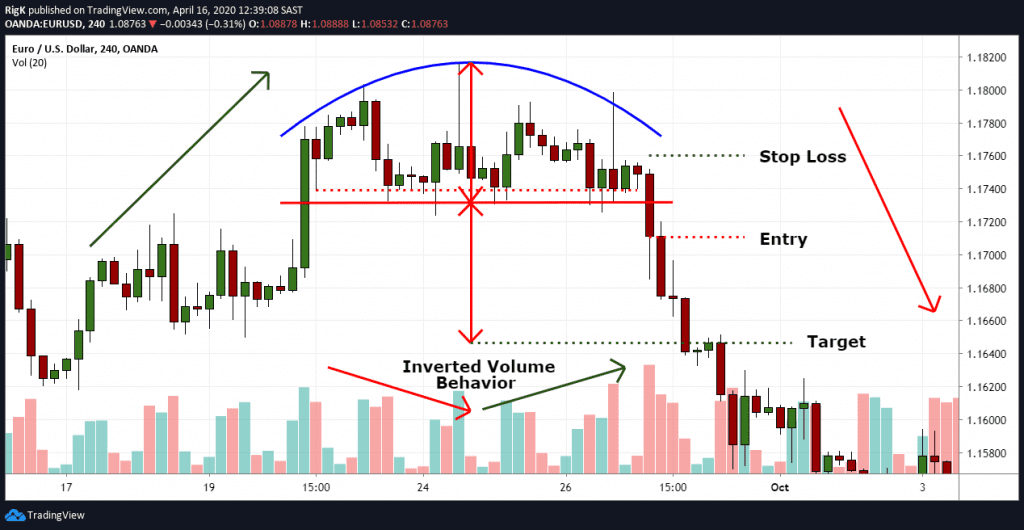

• ideally, volume and price will move in tandem. Unlike rounding bottom, the price objective is calculated according to the traditional pendulum rule. And visually, it resembles a simple curve that starts rising and then falls. • rounding top pattern occur at the end of long uptrends and indicate a potential reversal.

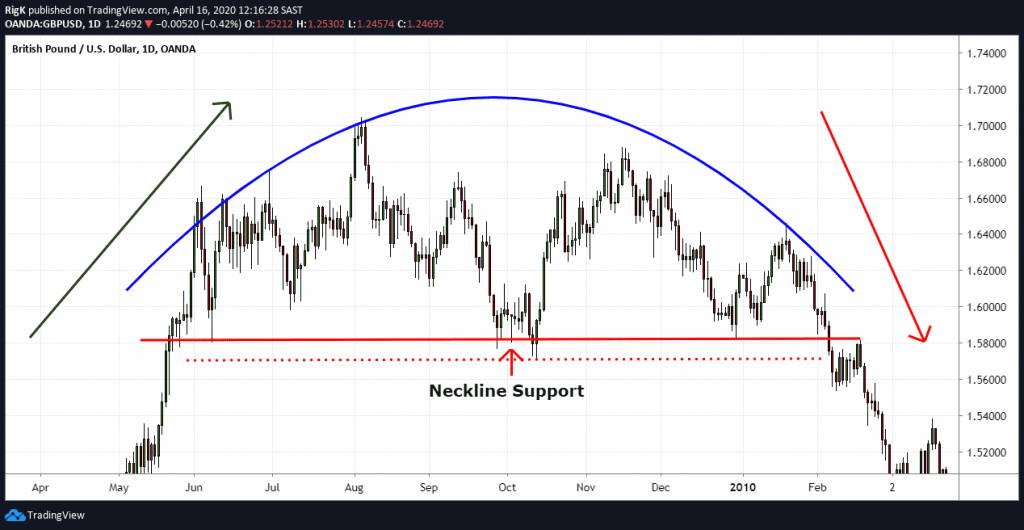

Web The Rounding Top Chart Pattern Is Used In Technical Analysis To Signal The Potential End Of An Uptrend And Consists Of A Rounded Top (Sometimes Referred To As An Inverse Saucer) And A Neckline Support Level Where Price Failed To Break Through On Numerous Occasions.

It is also referred to as “inverse saucer” as it looks similar to an inverted “u” shape. • rounding tops are found at the end of an uptrend trend and signify a reversal • it is also referred to as an inverted saucer. It denotes the stop of an uptrend and the likely start of a downtrend. Both these patterns are designed to identify the end of a price trend, and technical traders use them frequently to supplement their hypothesis of an upcoming reversal in trend.