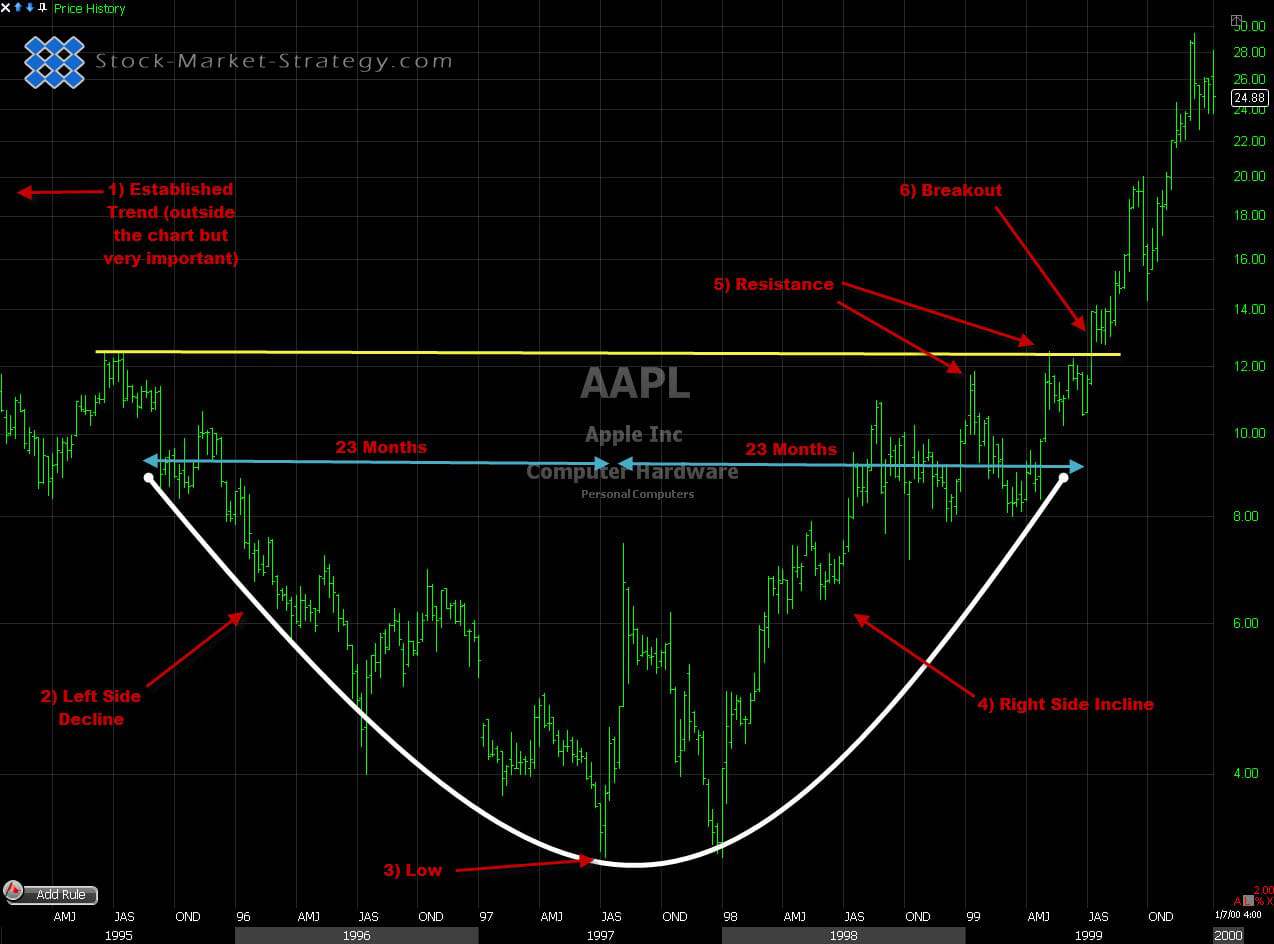

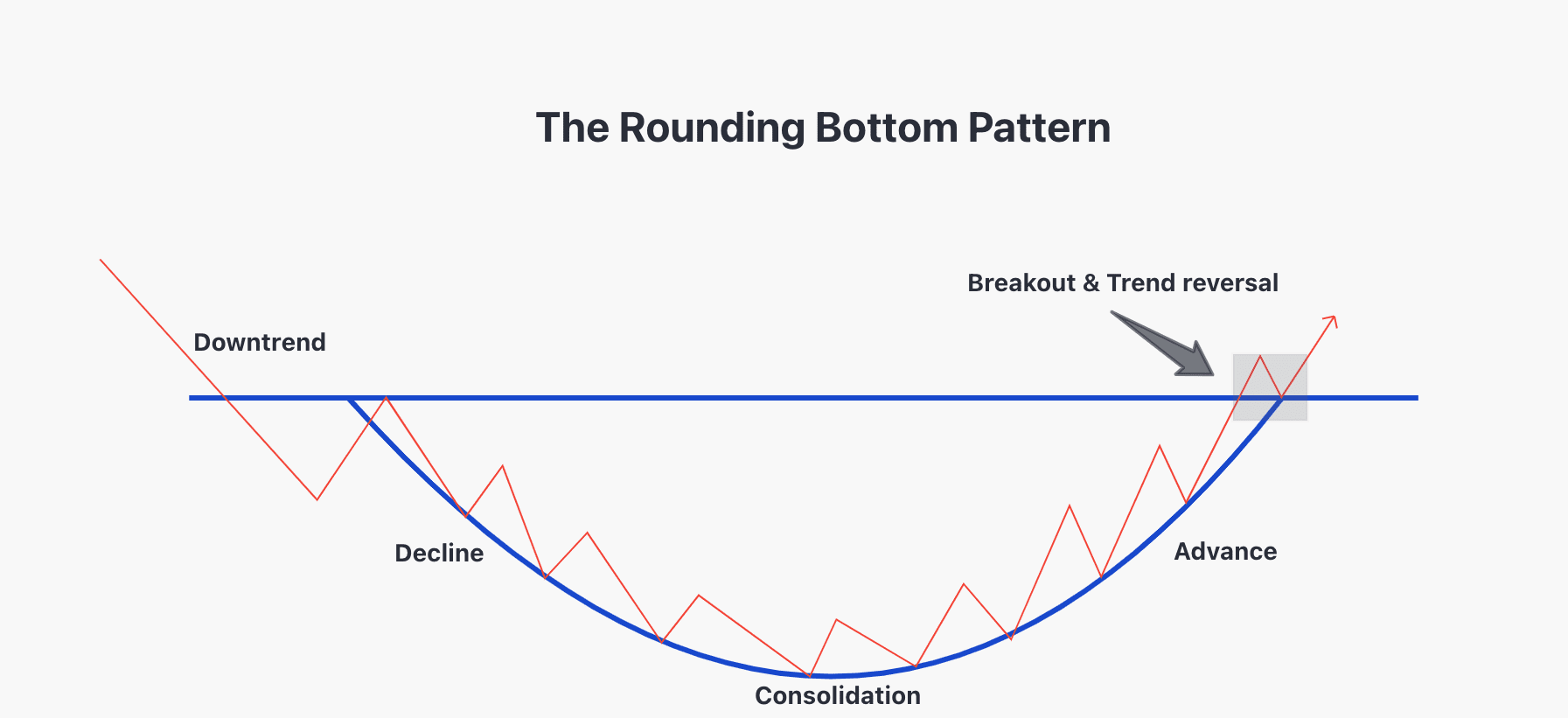

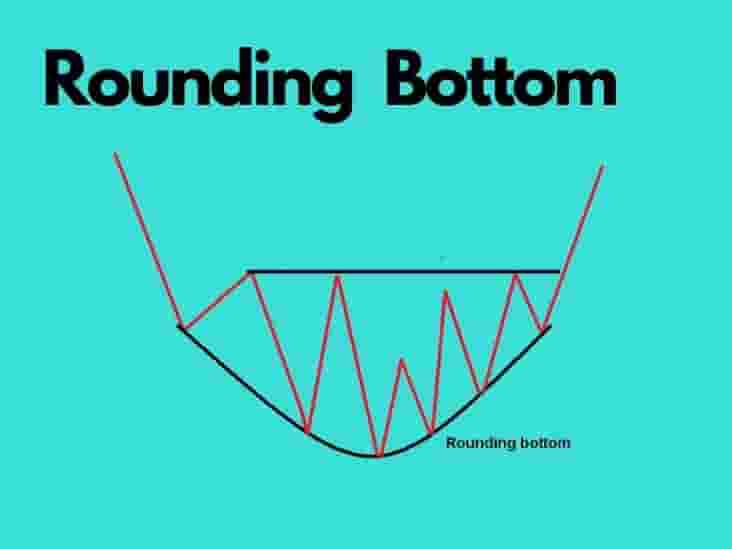

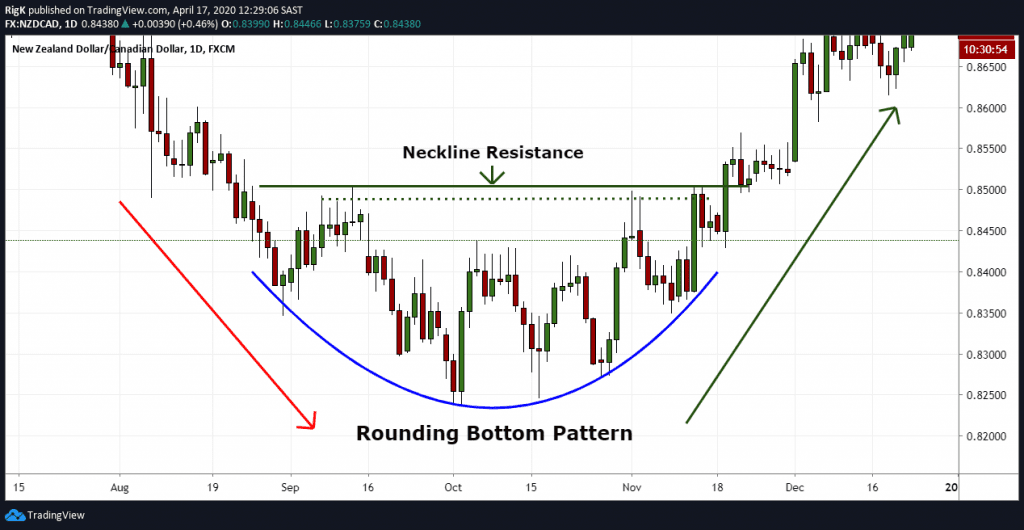

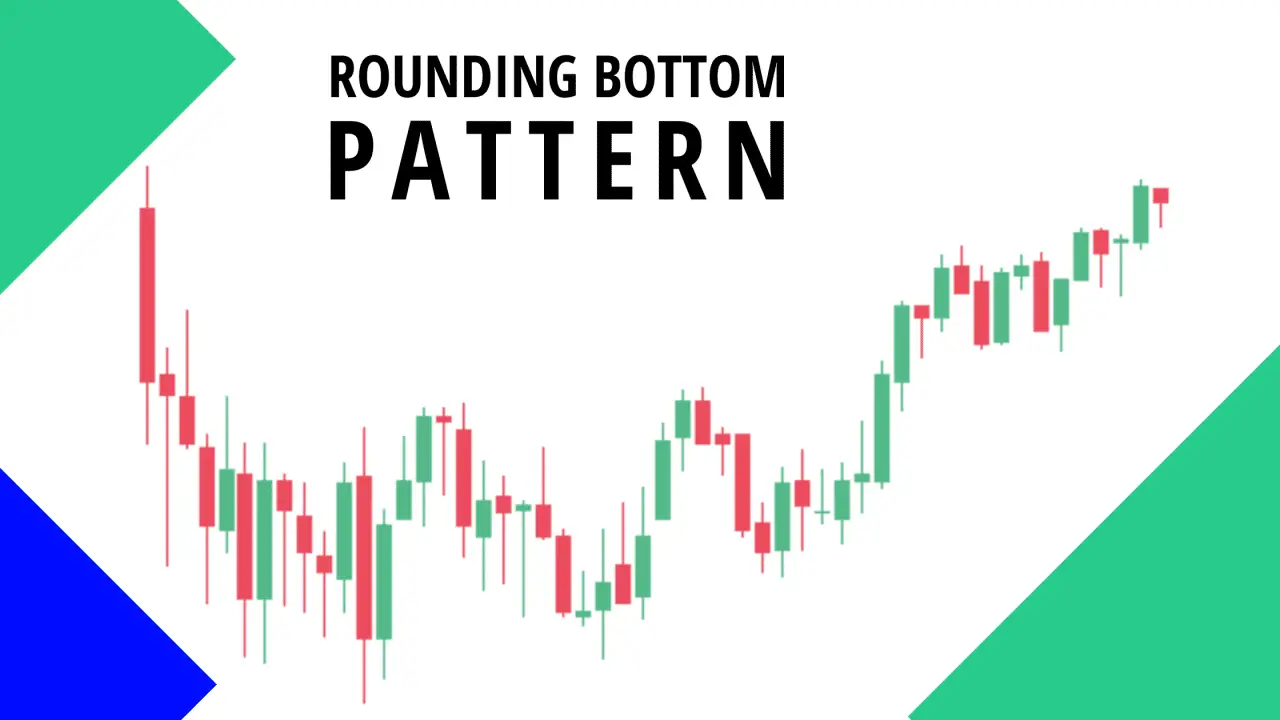

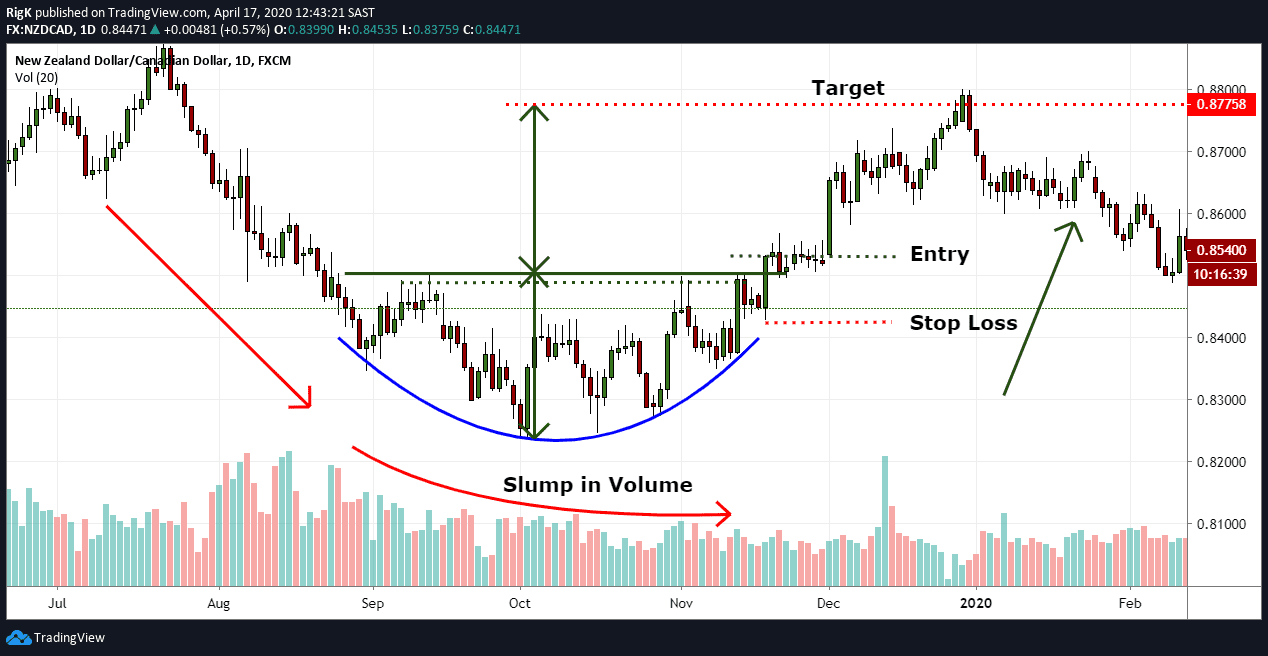

Web rounding bottom pattern is a bullish reversal chart formation signaling a potential shift from a downtrend to an uptrend. Web rounding bottoms are chart patterns that are difficult to spot unless you look on the weekly scale. Web scan stocks forming round bottom pattern with rsi above 50 and trading above supertrend in nifty 200 and cash segments. Showing page 1 of 7. The chart pattern represents a long consolidation.

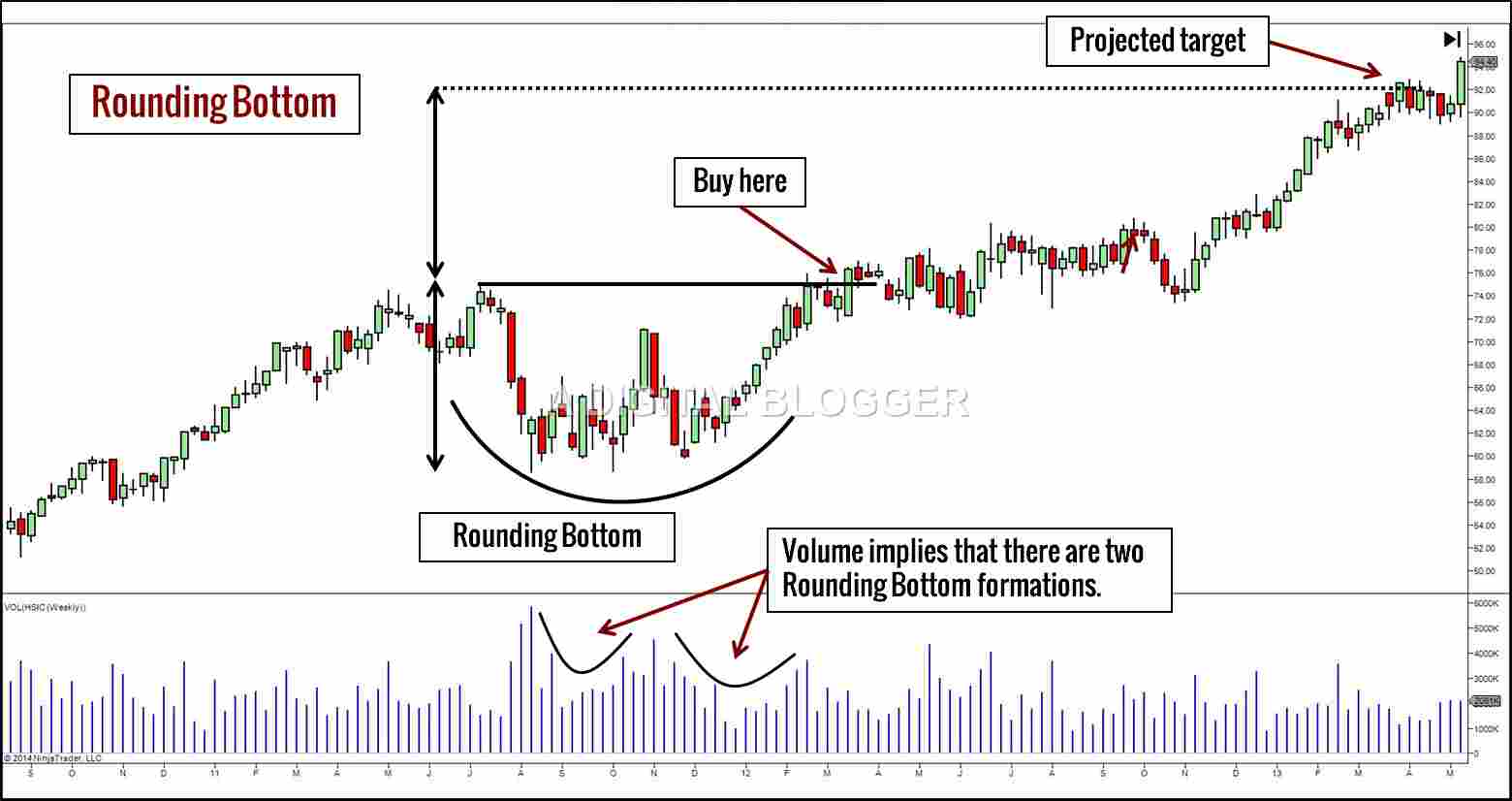

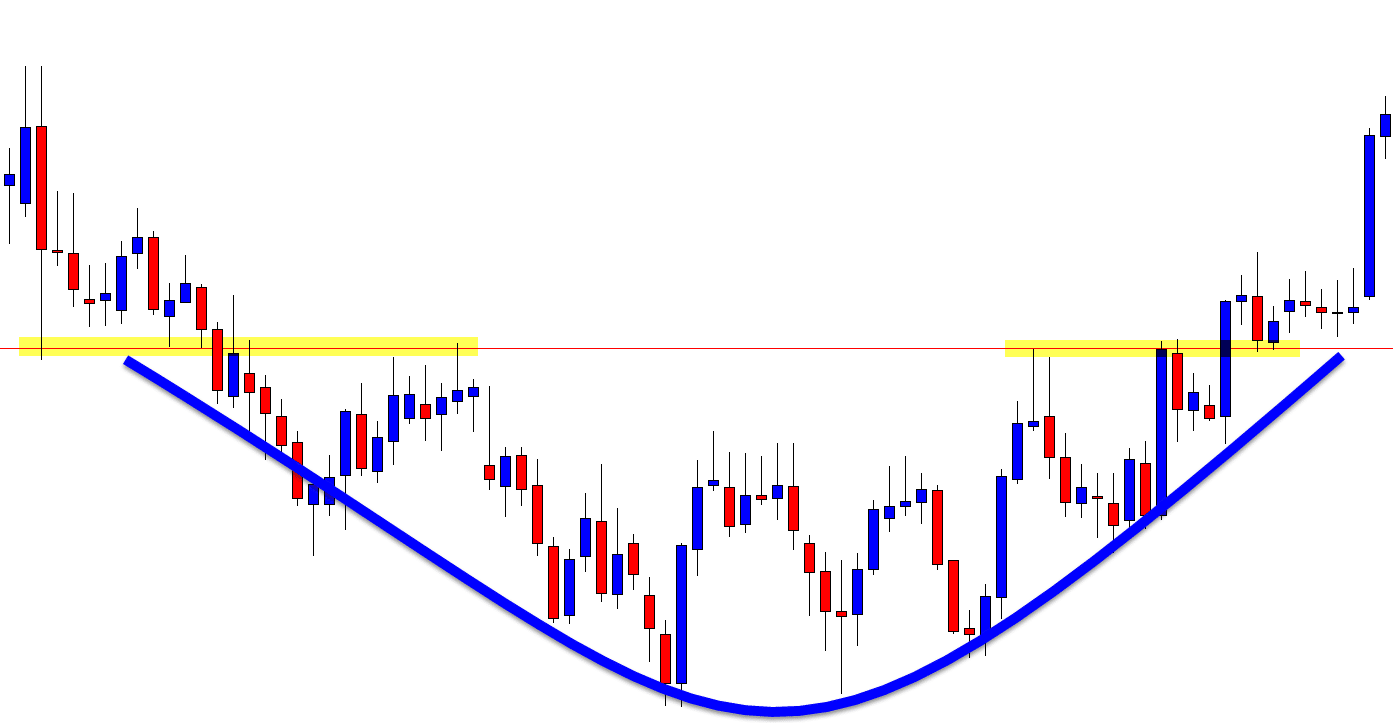

See an example of a rounding bottom chart pattern and its key features, such as volume, time frame, and breakout. Showing page 1 of 7. Conversely, a rounding top appears as an upside. Find out the six components of this pattern, the. Web a rounding bottom appears on a chart as a series of prices that form a ‘u’ shape, showing a gradual increase in price over time.

Both these patterns are designed to identify the. Showing page 1 of 7. • rounding bottoms are found at the end of. Often resembling a “u” shape on a price. See an example of a rounding bottom chart pattern and its key features, such as volume, time frame, and breakout.

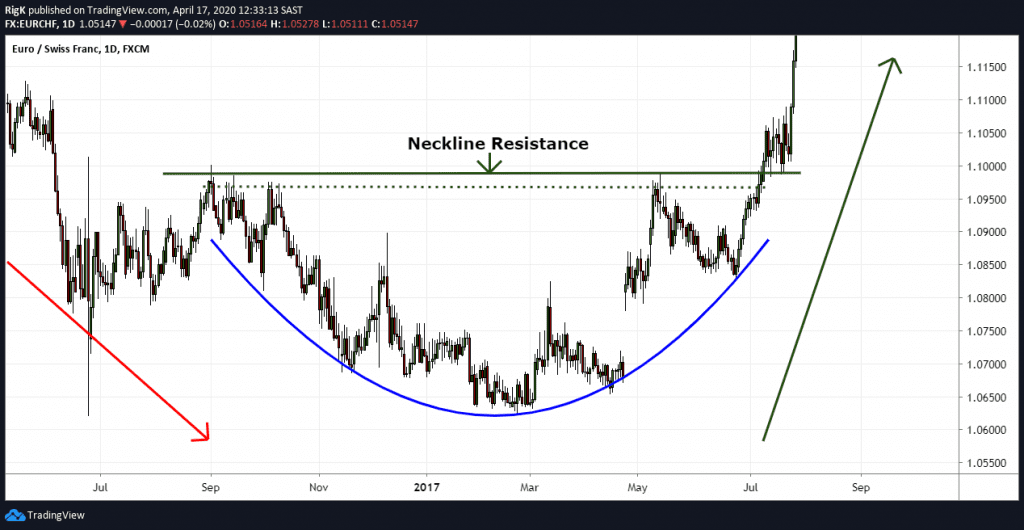

Web learn the steps to identify and profit from the rounding bottom pattern, a reversal chart setup that takes time to develop but has a high success rate. Conversely, a rounding top appears as an upside. Web the rounding bottom, also referred to as a saucer bottom, represents a bullish reversal pattern that typically emerges at the end of a downtrend. Both these patterns are designed to identify the. Web this includes the rounding top chart pattern and the rounding bottom chart pattern. The chart pattern represents a long consolidation. Web learn what a rounding bottom pattern is, how to identify it, and how to use it to trade with technical analysis tools. Web how to recognize a rounding bottom? Web scan stocks forming round bottom pattern with rsi above 50 and trading above supertrend in nifty 200 and cash segments. Learn what a rounding bottom is, how it forms, and how it indicates a positive market reversal. See scan description, examples, feedback. So, let’s jump right in and take a look at the rounding top chart pattern first. Web rounding bottom pattern is a bullish reversal chart formation signaling a potential shift from a downtrend to an uptrend. The break even failure rank is small and the average rise is large,. Find out the six components of this pattern, the.

Learn What A Rounding Bottom Is, How It Forms, And How It Indicates A Positive Market Reversal.

See an example of a rounding bottom chart pattern and its key features, such as volume, time frame, and breakout. Web rounding bottoms are chart patterns that are difficult to spot unless you look on the weekly scale. So, let’s jump right in and take a look at the rounding top chart pattern first. Conversely, a rounding top appears as an upside.

Web What Is A Rounding Bottom?

Showing page 1 of 7. See scan description, examples, feedback. Web scan stocks forming round bottom pattern with rsi above 50 and trading above supertrend in nifty 200 and cash segments. Web how to recognize a rounding bottom?

Web Learn What A Rounding Bottom Pattern Is, How To Identify It, And How To Use It To Trade With Technical Analysis Tools.

• rounding bottoms are found at the end of. Both these patterns are designed to identify the. Web rounding bottom is one of the conventional trading patterns that investors use in anticipating bullish market movements. The break even failure rank is small and the average rise is large,.

Web Learn How To Identify And Trade The Rounding Bottom Pattern, A Bullish Reversal Chart Pattern That Signals The End Of A Downward Trend And The Beginning.

Web rounding bottom pattern is a bullish reversal chart formation signaling a potential shift from a downtrend to an uptrend. The chart pattern represents a long consolidation. Web this includes the rounding top chart pattern and the rounding bottom chart pattern. Web a rounding bottom appears on a chart as a series of prices that form a ‘u’ shape, showing a gradual increase in price over time.