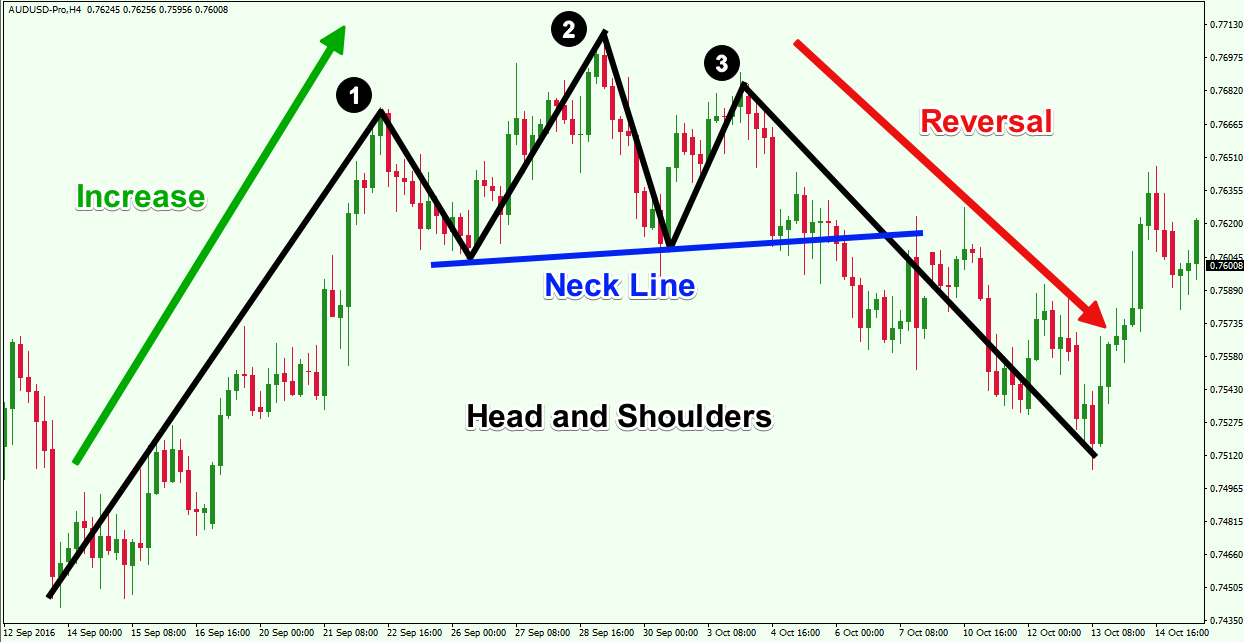

Head & shoulder and inverse head & shoulder. The head forms when enthusiasm peaks and then declines to a point at or near the stock's previous low. Web the head and shoulders chart pattern is popular and easy to spot when traders know what they're watching for. Following this, the price generally goes to the upside and starts a new uptrend. It is often referred to as an inverted head and shoulders pattern in downtrends, or simply the head and shoulders stock pattern in.

Web the head and shoulders chart pattern is popular and easy to spot when traders know what they're watching for. The pattern resembles the shape of a person’s head and two shoulders in an inverted position, with three consistent lows and peaks. Furthermore, the pattern appears at the end of a downward trend and should have a clear neckline used as a resistance level. Head & shoulder and inverse head & shoulder. Read about head and shoulder pattern here:

Web the head and shoulders chart pattern is a price reversal pattern that helps traders identify when a reversal may be underway after a trend is exhausted. The height of the pattern plus the breakout price should be your target price using this indicator. The left shoulder forms when the price falls to a new low, followed by a pullback. It is the opposite of the head and shoulders chart pattern,. Web an inverse head and shoulders pattern is a technical analysis pattern that signals a potential trend reversal in a downtrend.

Web an inverse head and shoulders pattern is a technical analysis pattern that signals a potential trend reversal in a downtrend. Read about head and shoulder pattern here: Analysts often use the chart for stocks, but also for trading in forex, commodities, and. This pattern is formed when an asset’s price creates a low (the “left shoulder”), followed by a lower low (the “head”), and then a higher low (the “right shoulder”). Historical pricing feeds the technical indicator and investors and analysts frequently use it to determine if a downward tendency is probable. Signals the traders to enter into long position above the neckline. The inverse head and shoulders, or the head and shoulders bottom, is a popular chart pattern used in technical analysis. Web the head and shoulders pattern is a reversal trend, indicating price movement is changing from bullish to bearish. Web the head and shoulders pattern is a reversal trading strategy, which can develop at the end of bullish or bearish trends. Web the head and shoulders chart pattern is popular and easy to spot when traders know what they're watching for. Web the head and shoulders chart pattern is a price reversal pattern that helps traders identify when a reversal may be underway after a trend is exhausted. This reversal could signal an. The pattern is never perfect in shape, as price fluctuations can happen in between the shifts. “head and shoulder bottom” is also the same thing. Inverse h&s pattern is bullish reversal pattern.

Inverse H&S Pattern Is Bullish Reversal Pattern.

Historical pricing feeds the technical indicator and investors and analysts frequently use it to determine if a downward tendency is probable. “head and shoulder bottom” is also the same thing. Volume play a major role in both h&s and inverse h&s patterns. However, if traded correctly, it allows you to identify high probability breakout trades, catch the start of a new trend, and even “predict” market bottoms ahead of time.

Web The Head And Shoulders Chart Pattern Is A Price Reversal Pattern That Helps Traders Identify When A Reversal May Be Underway After A Trend Has Exhausted Itself.

It's one of the most reliable trend reversal patterns. Following this, the price generally goes to the upside and starts a new uptrend. It is of two types: Web inverse head and shoulders is a price pattern in technical analysis that signals a potential reversal from a downtrend to an uptrend.

The Pattern Resembles The Shape Of A Person’s Head And Two Shoulders In An Inverted Position, With Three Consistent Lows And Peaks.

Web what is the inverse head and shoulders pattern? Web the inverse head and shoulders chart pattern is a bullish chart formation that signals a potential reversal of a downtrend. The left shoulder forms when the price falls to a new low, followed by a pullback. The height of the pattern plus the breakout price should be your target price using this indicator.

The Inverse Head And Shoulders Pattern Is A Bullish Reversal Pattern.

Web inverse head and shoulders pattern is the mirror image of head and shoulders pattern. The right shoulder on these patterns typically is higher than the left, but many times it’s equal. Web inverted head and shoulders is a reversal pattern formed by three consecutive lows and two intermediate highs. The pattern is never perfect in shape, as price fluctuations can happen in between the shifts.

![Inverse Head And Shoulders Pattern [2023 Update] Daily Price Action](https://dailypriceaction.com/wp-content/uploads/2015/03/4-hour-inverse-head-and-shoulders-confirmed.png)