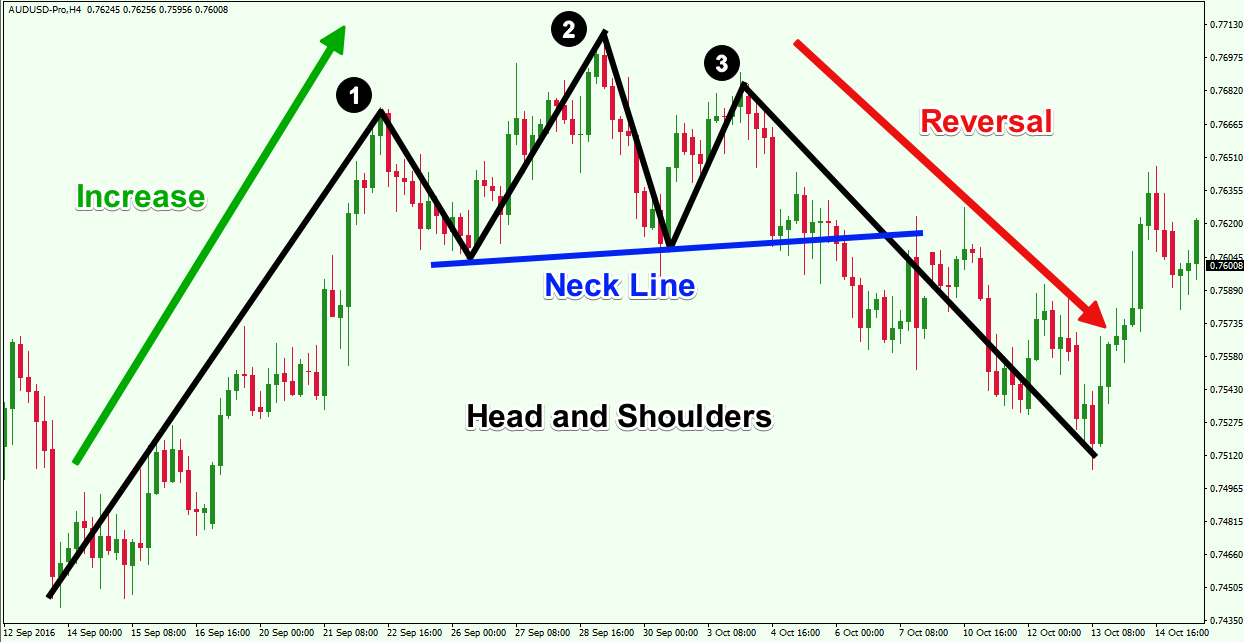

Web the left arm can remain down at your side or place hand on hip. Formation of the inverse head and shoulders pattern seen at market bottoms: Technical & fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth, book vlaue, market cap,. “head and shoulder bottom” is also the same thing. Web the head and shoulders chart pattern is a price reversal pattern that helps traders identify when a reversal may be underway after a trend has exhausted itself.

“head and shoulder bottom” is also the same thing. Web an inverse head and shoulders pattern is a technical analysis pattern that signals a potential trend reversal in a downtrend. Web step one foot slightly back behind you with a bent knee and the weight on the ball of the foot. Web what is a head and shoulders pattern? Web an inverse head and shoulders pattern is a technical analysis chart pattern that signals a potential trend reversal from a downtrend to an uptrend.

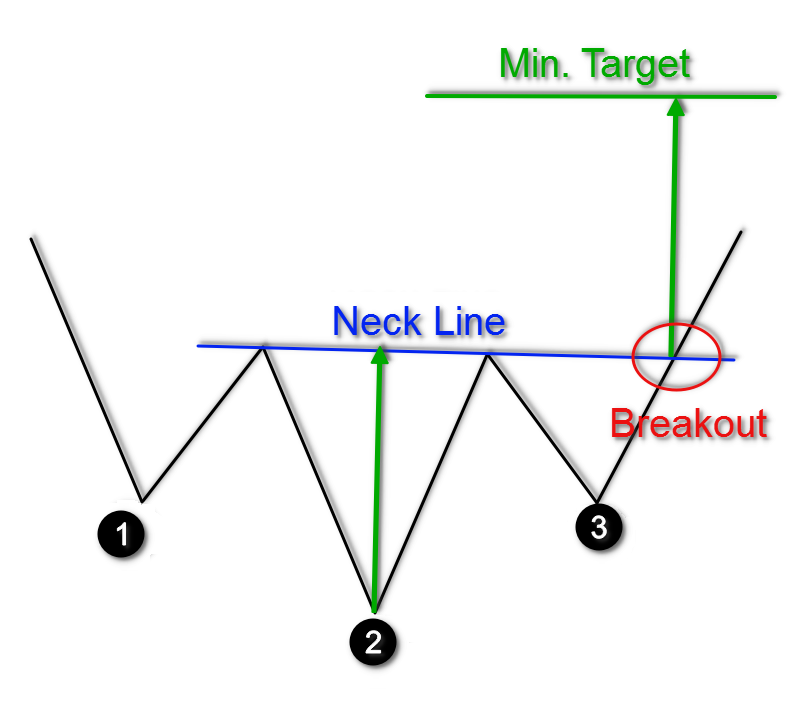

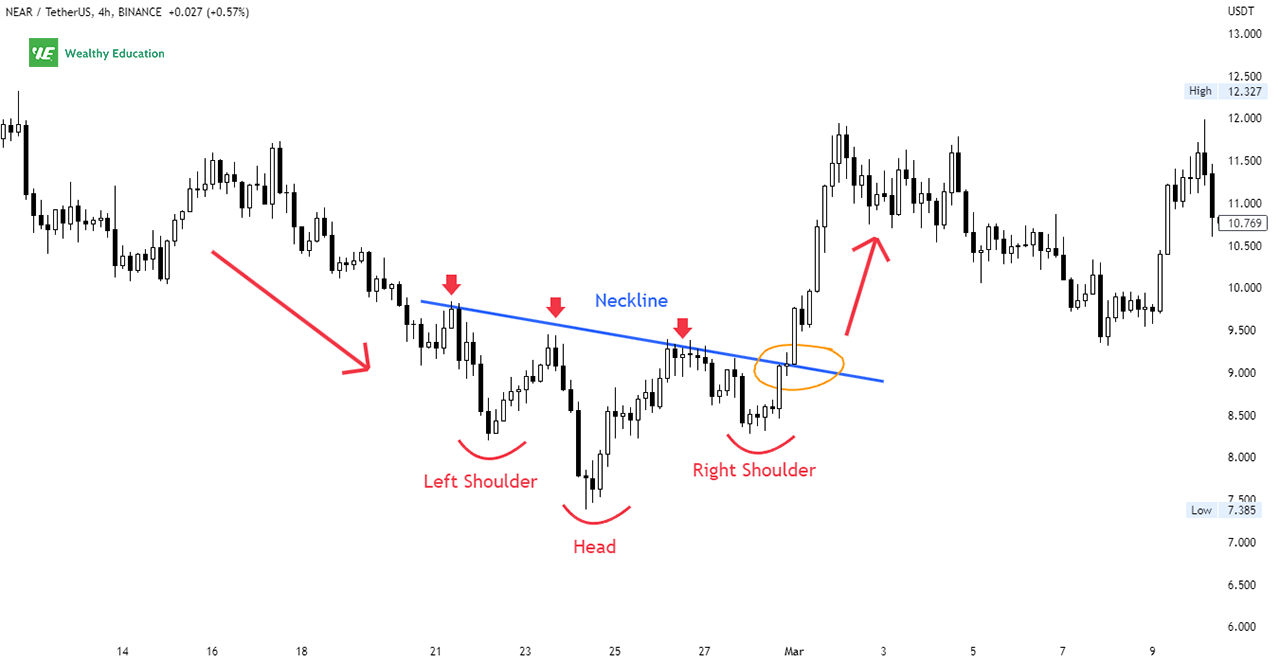

Following this, the price generally goes to the upside and starts a new uptrend. This pattern is formed when an asset’s price creates a low (the “left shoulder”), followed by a lower low (the “head”), and then a higher low (the “right shoulder”). Web the inverse head and shoulders pattern is a chart pattern that has fooled many traders (i’ll explain why shortly). Both “inverse” and “reverse” head and shoulders patterns are the same. Formation of the inverse head and shoulders pattern seen at market bottoms:

As such, it is a bearish pattern that signals a reversal. Web the inverse head and shoulders pattern is a technical indicator that signals a potential reversal from a downward trend to an upward trend. Web the inverse head and shoulders chart pattern is a bullish chart formation that signals a potential reversal of a downtrend. It is the opposite of the head and shoulders chart pattern, which is a. Technical & fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth, book vlaue, market cap,. Keep core tight and spine neutral. This reversal could signal an. It represents a bullish signal suggesting a potential reversal of a current downtrend. Both “inverse” and “reverse” head and shoulders patterns are the same. Web an inverse head and shoulders pattern is a technical analysis chart pattern that signals a potential trend reversal from a downtrend to an uptrend. Scanner guide scan examples feedback. Find out how to detect and use this chart pattern to improve your trading. Hinge at the hips while keeping the weight in the supporting leg, lowering the weight towards the. Formation of the inverse head and shoulders pattern seen at market bottoms: The pattern appears as a head, 2 shoulders, and neckline in an inverted position.

Keep Core Tight And Spine Neutral.

Web the head and shoulders chart pattern is a price reversal pattern that helps traders identify when a reversal may be underway after a trend is exhausted. Price declines followed by a price bottom, followed by an. The pattern consists of 3. Web inverted head and shoulders is a reversal pattern formed by three consecutive lows and two intermediate highs.

The Head And Shoulders Stock Pattern Is A Common Tool To Help Identify The Fall Of A Previously Rising Stock.

This pattern is formed when an asset’s price creates a low (the “left shoulder”), followed by a lower low (the “head”), and then a higher low (the “right shoulder”). The first and third lows are called shoulders. Hinge at the hips while keeping the weight in the supporting leg, lowering the weight towards the. Web the inverse head and shoulders pattern is a technical indicator that signals a potential reversal from a downward trend to an upward trend.

The Right Shoulder On These Patterns Typically Is Higher Than The Left, But Many Times It’s Equal.

Scanner guide scan examples feedback. It is the opposite of the head and shoulders chart pattern, which is a. The height of the pattern plus the breakout price should be your target price using this indicator. Web inverse head and shoulders pattern.

It Is Of Two Types:

Head & shoulder and inverse head & shoulder. Web an inverse head and shoulders pattern is a technical analysis pattern that signals a potential trend reversal in a downtrend. Furthermore, the pattern appears at the end of a downward trend and should have a clear neckline used as a resistance level. It represents a bullish signal suggesting a potential reversal of a current downtrend.