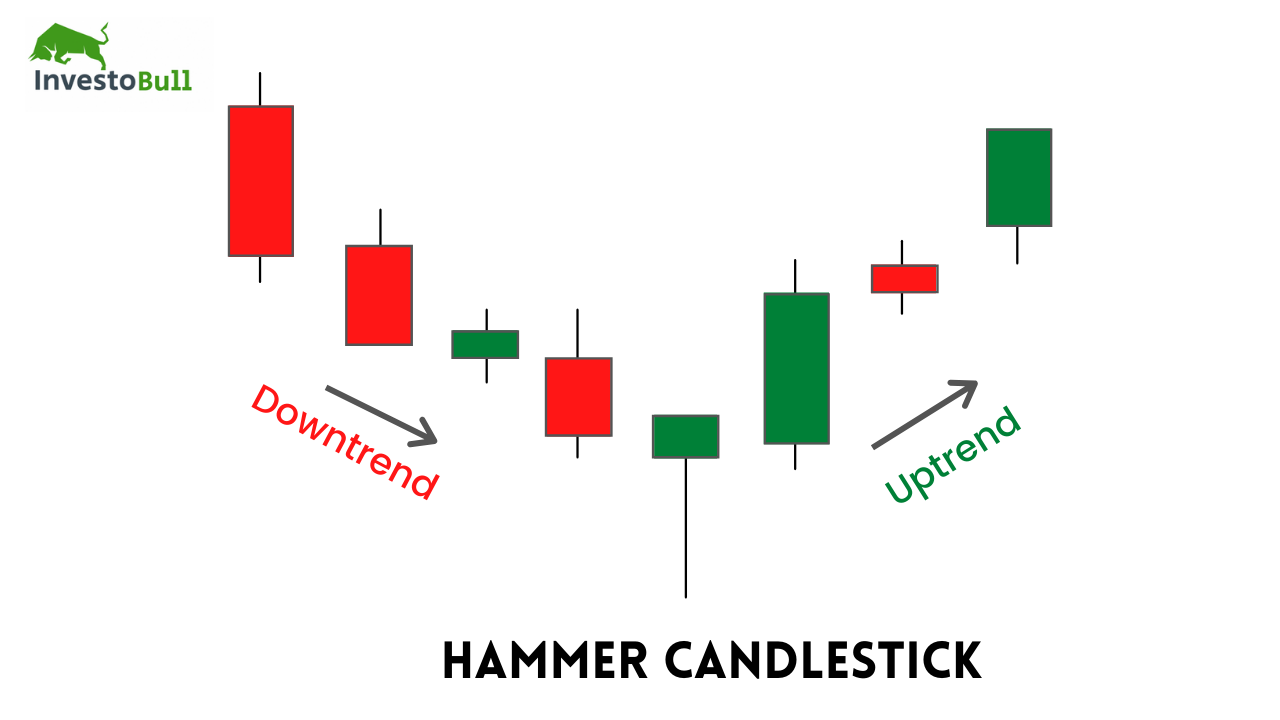

Web hammer candlesticks are a popular reversal pattern formation found at the bottom of downtrends. The hammer candlestick pattern is a candle with a short body at the upper end and a long lower shadow, typically twice the body’s length,. Web what is a hammer candlestick pattern? Mysz have been struggling lately and have lost 11.1% over the past week. Because they are simple to understand and tend to work.

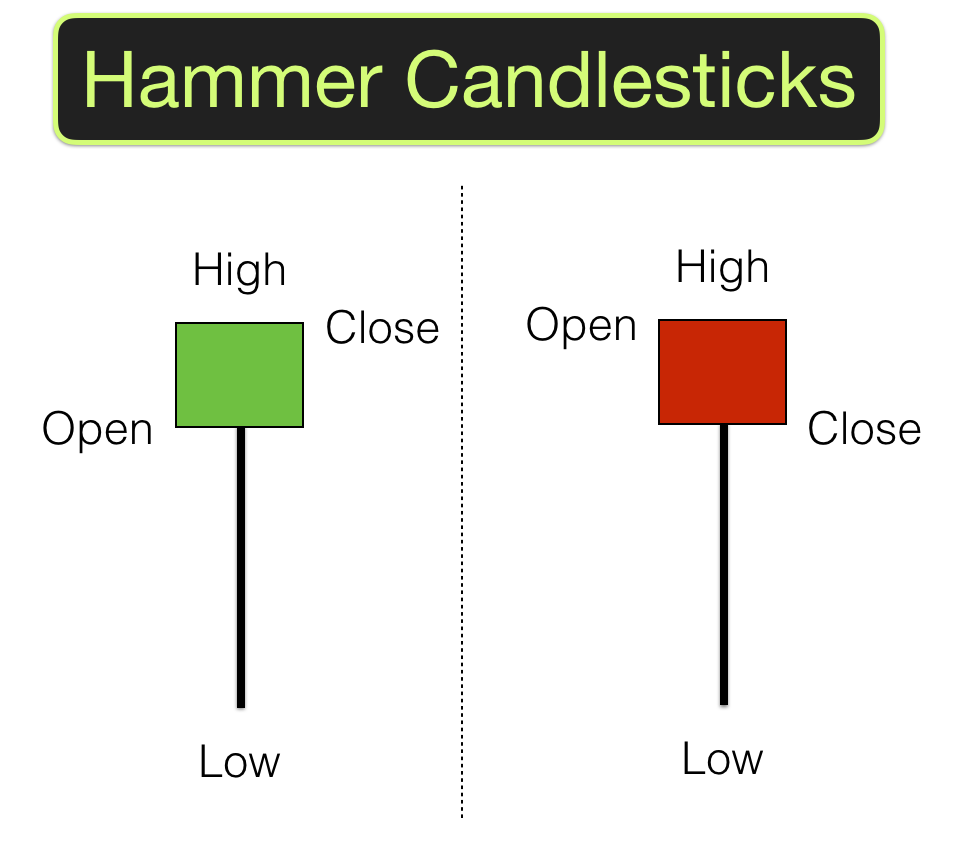

Web the hammer candlestick is a significant pattern in the realm of technical analysis, vital for predicting potential price reversals in markets. Web the hammer candlestick pattern is a bullish candlestick that is found at a swing low. It resembles a candlestick with a small body and a long lower wick. Web the hammer candlestick formation is viewed as a bullish reversal candlestick pattern that mainly occurs at the bottom of downtrends. The opening price, close, and top are approximately at the same.

Web the hammer candlestick pattern is a single candle formation that occurs in the candlestick charting of financial markets. Web eur/gbp hammer candlestick at area of value: It appears during the downtrend and signals that the bottom. This article will focus on the famous hammer candlestick pattern. Web understanding hammer chart and the technique to trade it.

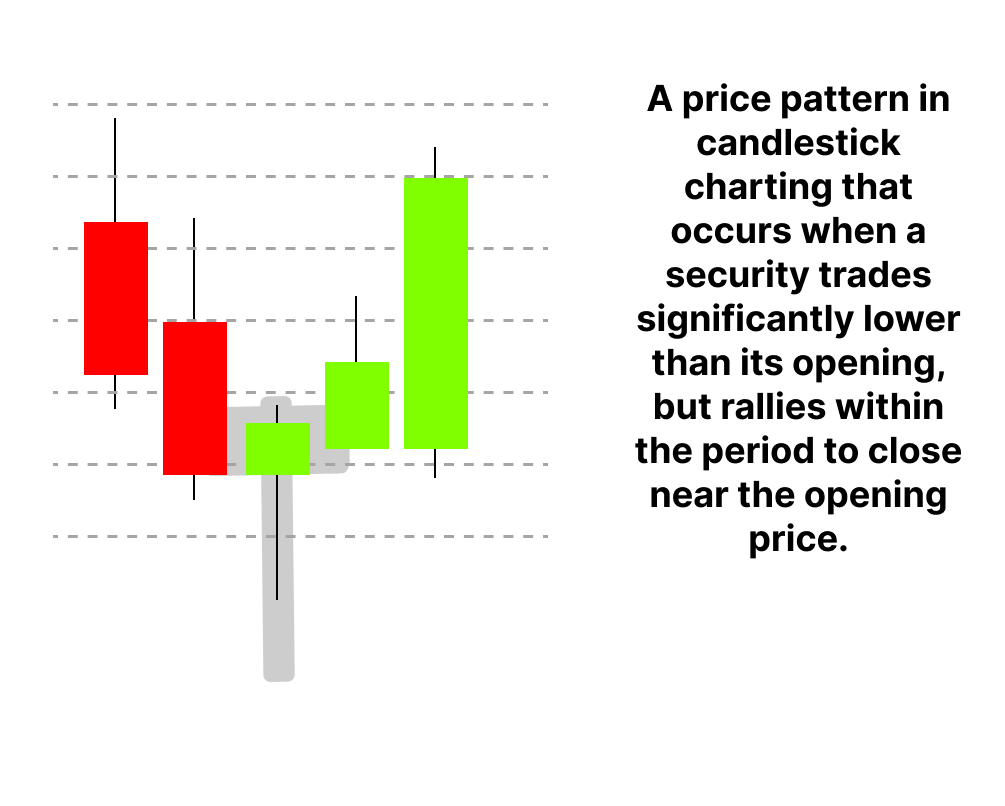

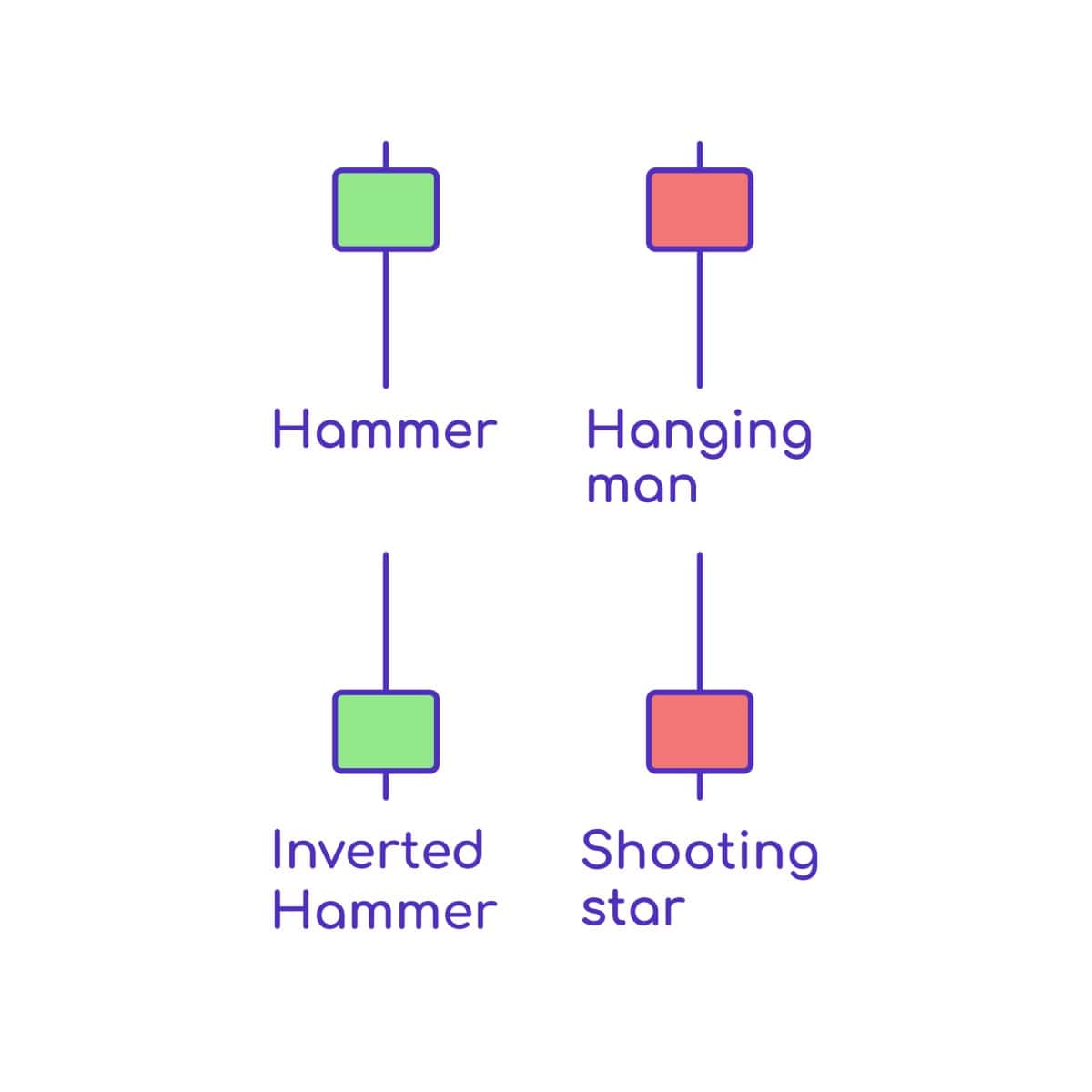

A small real body, long. It appears during the downtrend and signals that the bottom. Web understanding hammer chart and the technique to trade it. This candlestick pattern is a bullish reversal single candle pattern, which indicates a downtrend reversal in a stock. Web the hammer candlestick as shown above is a bullish reversal pattern that signals a potential price bottom followed by an upward move. Web a hammer is a price pattern in candlestick charting that occurs when a security trades significantly lower than its opening, but rallies within the period to close. #pattern #candle #stick #inverted hammer #patterns #candlestick. The hammer candlestick pattern is a candle with a short body at the upper end and a long lower shadow, typically twice the body’s length,. Web what is a hammer candlestick pattern? Web in this blog post, we are going to explore the hammer candlestick pattern, a bullish reversal candlestick. Web the hammer candlestick pattern is a bullish candlestick that is found at a swing low. This is one of the popular price patterns in candlestick charting. They consist of small to medium size lower shadows, a real. This article will focus on the famous hammer candlestick pattern. The opening price, close, and top are approximately at the same.

Web Jun 11, 202406:55 Pdt.

#pattern #candle #stick #inverted hammer #patterns #candlestick. It manifests as a single. Web the hammer candlestick pattern is a single candle formation that occurs in the candlestick charting of financial markets. This pattern typically appears when a.

Web A Hammer Candlestick Is A Term Used In Technical Analysis.

Because they are simple to understand and tend to work. Shares of my size, inc. Web the hammer candlestick pattern is a bullish reversal pattern that indicates a potential price reversal to the upside. Web the hammer candlestick as shown above is a bullish reversal pattern that signals a potential price bottom followed by an upward move.

The Hammer Candlestick Pattern Is A Candle With A Short Body At The Upper End And A Long Lower Shadow, Typically Twice The Body’s Length,.

Web what is a hammer candlestick pattern? Web what is a hammer candlestick pattern? This candlestick pattern is a bullish reversal single candle pattern, which indicates a downtrend reversal in a stock. Mysz have been struggling lately and have lost 11.1% over the past week.

Web Hammer Candlestick Pattern Consists Of A Single Candlestick & Its Name Is Derived From Its Shape Like A Hammer Having Long Wick At Bottom And A Little Body At Top.

The hammer signals that price may be about to make a reversal back higher after a recent. Let’s break down the basics: It resembles a candlestick with a small body and a long lower wick. The hammer candlestick is a popular chart pattern that suggests bullish sentiment after a day of trading volatility.