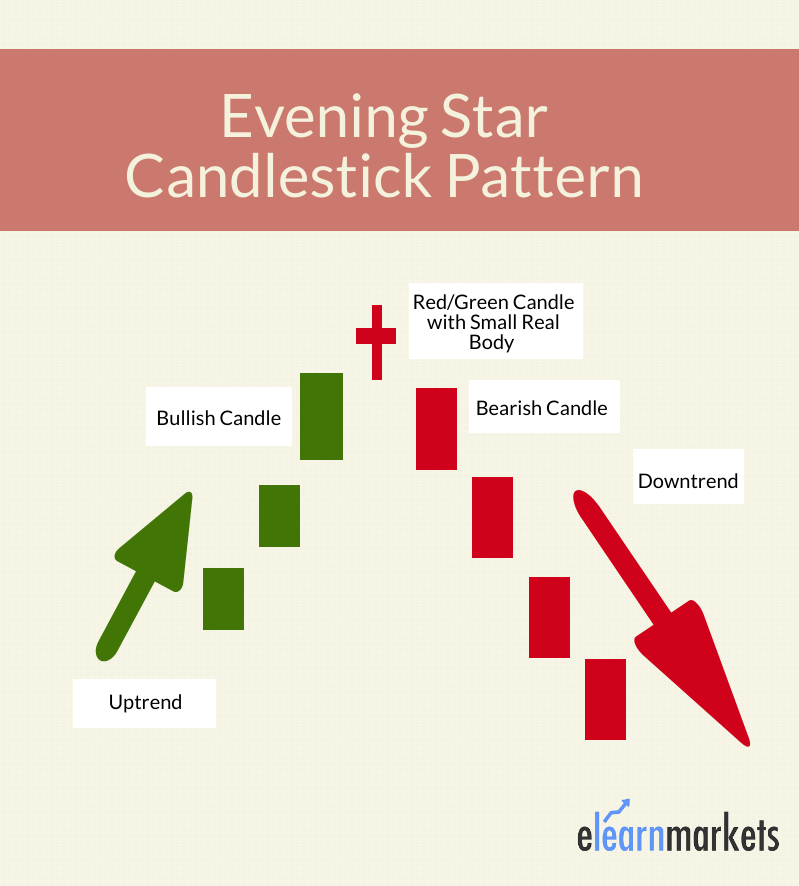

It consists of three candles: Evening star patterns appear at the top of a price uptrend, signalling that the uptrend is going to end. The best evening star trading strategy is a bullish mean reversion strategy in the stock and crypto markets and a bearish mean reversion strategy in the forex market. This guide explains what the evening star pattern is and how to recognize and interpret it with the help of an example chart and trade. 2.1 what is the morning star pattern?

What to do in the evening in orlando??? Web an evening star is a candlestick pattern that is used by technical analysts for analyzing when a trend is about to reverse. It's a bearish candlestick pattern that consists of three. Web the evening star pattern is viewed as a bearish reversal pattern in technical analysis. As to the appearance, the first candle is bullish, the second a doji that gaps up, and the third candle gaps down and closes lower than it opened.

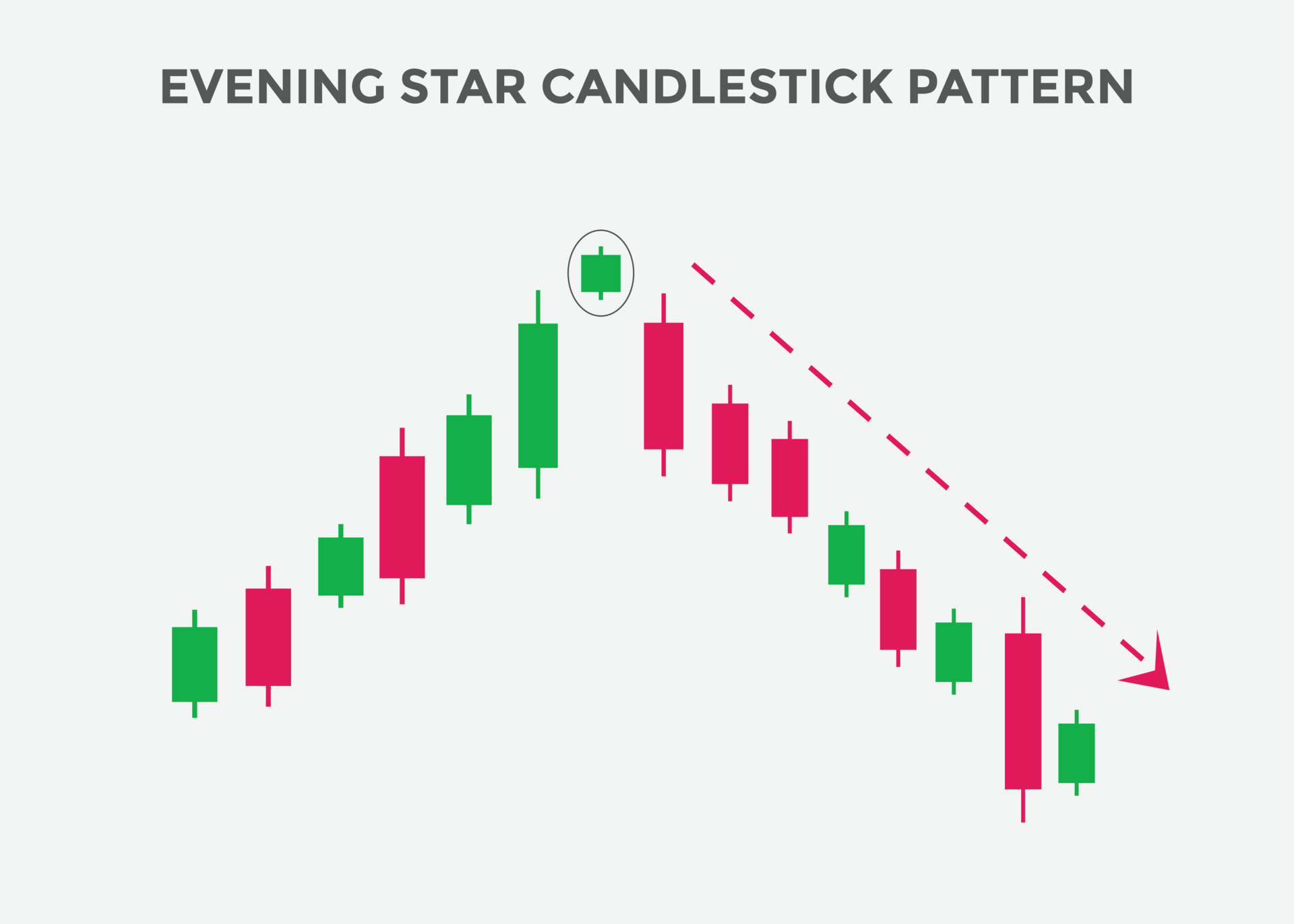

4 evening star pattern example. Web an evening star is a bearish reversal candlestick pattern comprising three candles: Web the evening star pattern is viewed as a bearish reversal pattern in technical analysis. Web an evening star is a three candle bearish reversal pattern that forms after an uptrend, and signals that the bullish trend is coming to an end and will give room for bearish developments. 2.1 what is the morning star pattern?

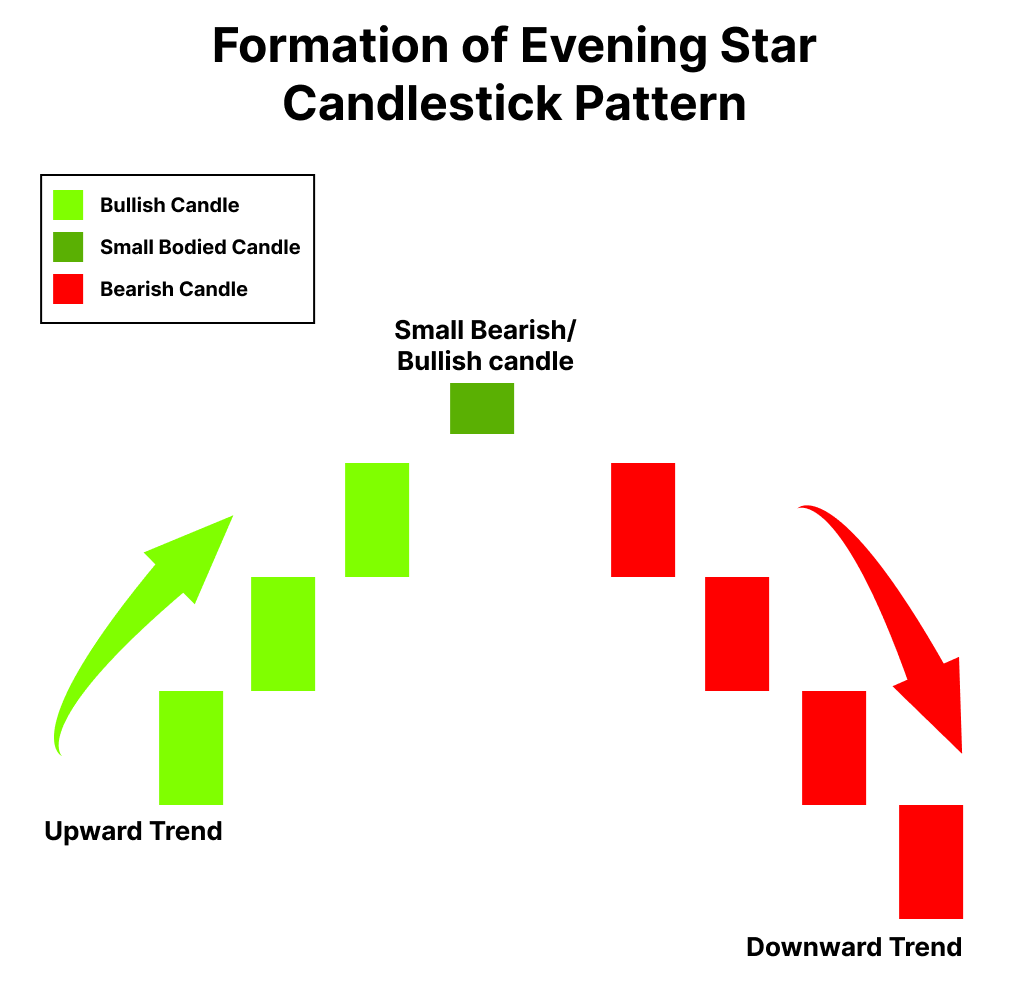

Web an evening star is a three candle bearish reversal pattern that forms after an uptrend, and signals that the bullish trend is coming to an end and will give room for bearish developments. Web by the end of this video, you'll have a comprehensive understanding of the evening star candlestick pattern and how to effectively use it in your trading. Web the evening star candlestick pattern is a powerful bearish reversal pattern that traders can use to identify a potential trend change at the top of an uptrend. As such, it usually appears at the end of an uptrend and beginning of a downtrend. Orlando evening star was published in orlando, florida and includes 490,675 searchable pages from. Web evening star is a bearish trend reversal candlestick pattern consisting of three candles. The pattern is made up of three main candlesticks. Web evening star is a bearish reversal candlestick that appears at the top of an uptrend and signals a potential change in momentum. Web 1 the stock market battlefield. 2.1 what is the morning star pattern? This guide explains what the evening star pattern is and how to recognize and interpret it with the help of an example chart and trade. Web the evening star candle pattern is a bearish reversal signal in technical analysis, providing traders with potential insight into market momentum shifts. It usually occurs at the top of an uptrend. Forming what many candlestick enthusiasts would refer to as an ‘evening star candlestick pattern’. It signals the slowing down of upward momentum before a bearish.

The First Line Is Any White Candle Appearing As A Long Line In An Uptrend:

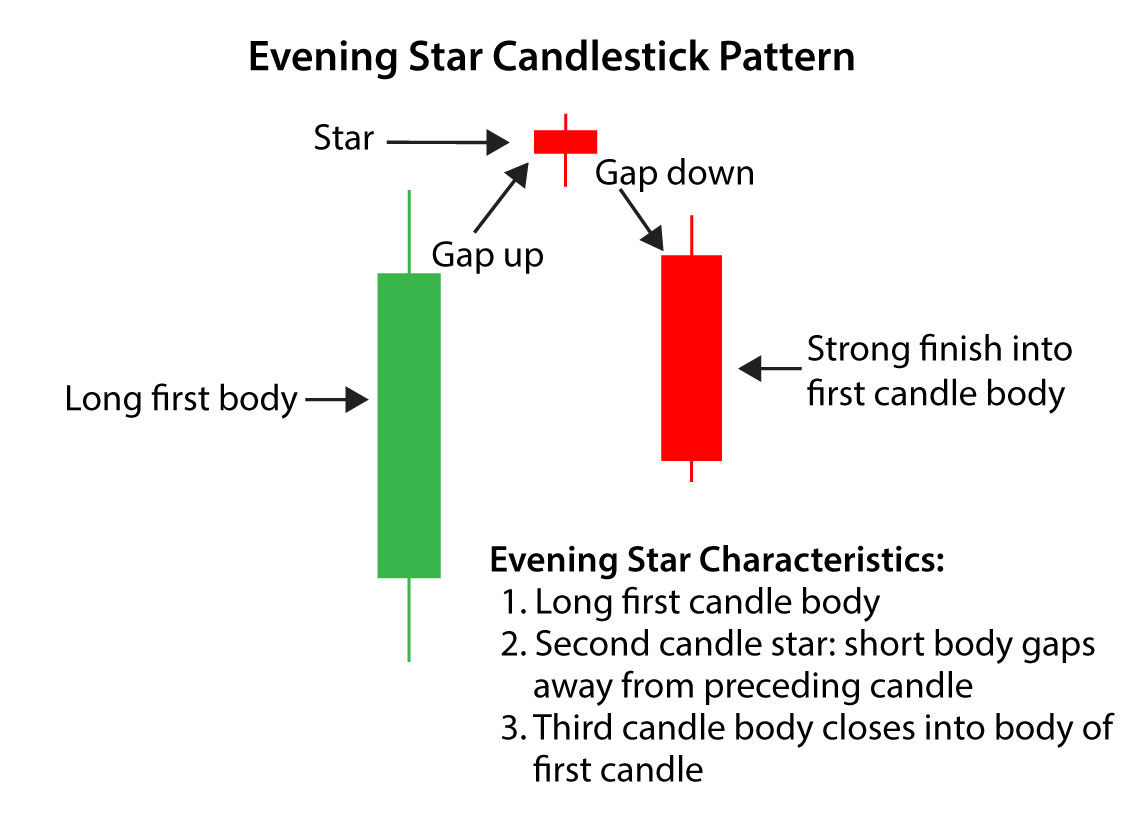

As to the appearance, the first candle is bullish, the second a doji that gaps up, and the third candle gaps down and closes lower than it opened. Web the evening star candlestick pattern is a powerful bearish reversal pattern that traders can use to identify a potential trend change at the top of an uptrend. Orlando evening star was published in orlando, florida and includes 490,675 searchable pages from. Web the evening star is a bearish reversal pattern in technical analysis that is identified by a tall bullish candle followed by a small candle that gaps above the first candle, and then a third candle that is bearish and closes below the midpoint of the first candle.

This Guide Explains What The Evening Star Pattern Is And How To Recognize And Interpret It With The Help Of An Example Chart And Trade.

Web by the end of this video, you'll have a comprehensive understanding of the evening star candlestick pattern and how to effectively use it in your trading. The pattern is made up of three main candlesticks. This pattern can help you make informed decisions and capture profitable trades correctly. Find out more here.| thinkmarkets | en.

Web The Evening Star Pattern Is Viewed As A Bearish Reversal Pattern In Technical Analysis.

The best evening star trading strategy is a bullish mean reversion strategy in the stock and crypto markets and a bearish mean reversion strategy in the forex market. The pattern usually forms over three days. Consisting of three candles, the pattern usually forms at the end of an uptrend, suggesting a possible downturn in the market. Web evening star is a bearish reversal candlestick that appears at the top of an uptrend and signals a potential change in momentum.

A Long Bullish Candle, Followed By A Short Candle Or A Doji That Gaps Above The First Candle, And Finally A Long Bearish Candle That Falls Into The Body Of The First Candle.

The second candle is short and gaps up from the first one; The evening star candlestick pattern is recognized if: Web an evening star is a stock price chart pattern that's used by technical analysts to detect when a trend is about to reverse. Forming what many candlestick enthusiasts would refer to as an ‘evening star candlestick pattern’.