Web looking to gain a better understanding of bullish candlestick patterns? How to set entries and risk for each; Web bullish candlestick patterns are a sign of the end of a downtrend. Learn how these patterns work and which 8 ones you should know. To that end, we’ll be covering the fundamentals of.

Sure, it is doable, but it requires special training and expertise. Web bullish candlesticks indicate entry points for long trades, and can help predict when a downtrend is about to turn around to the upside. Web looking to gain a better understanding of bullish candlestick patterns? We provide a list of bullish signals to help you make informed trading decisions. There are dozens of different candlestick patterns with intuitive, descriptive.

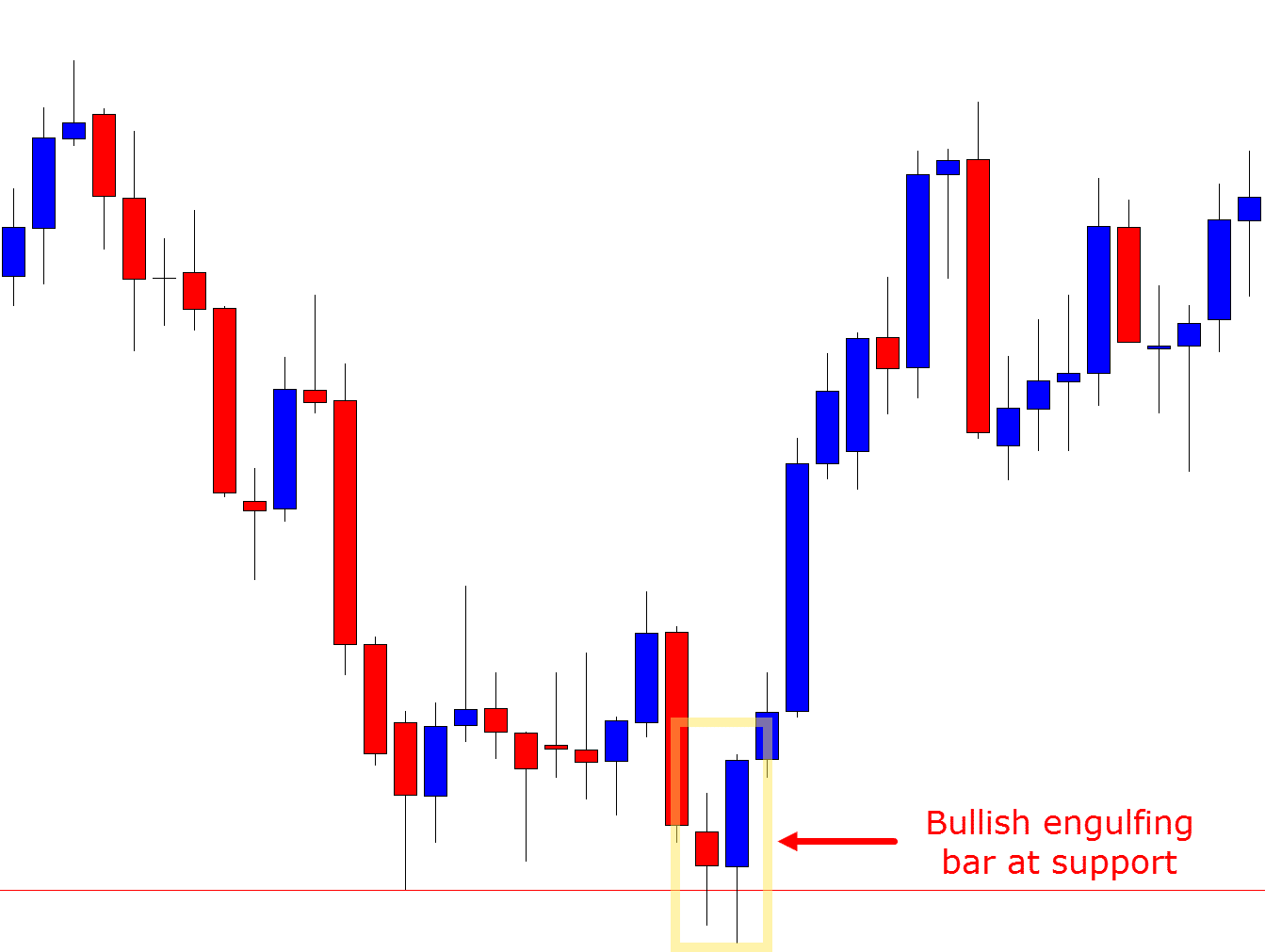

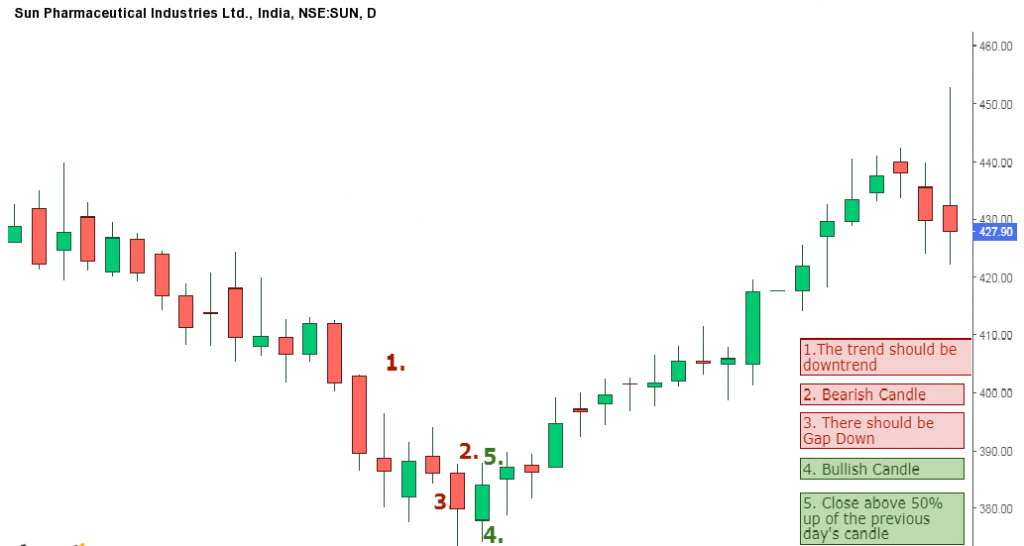

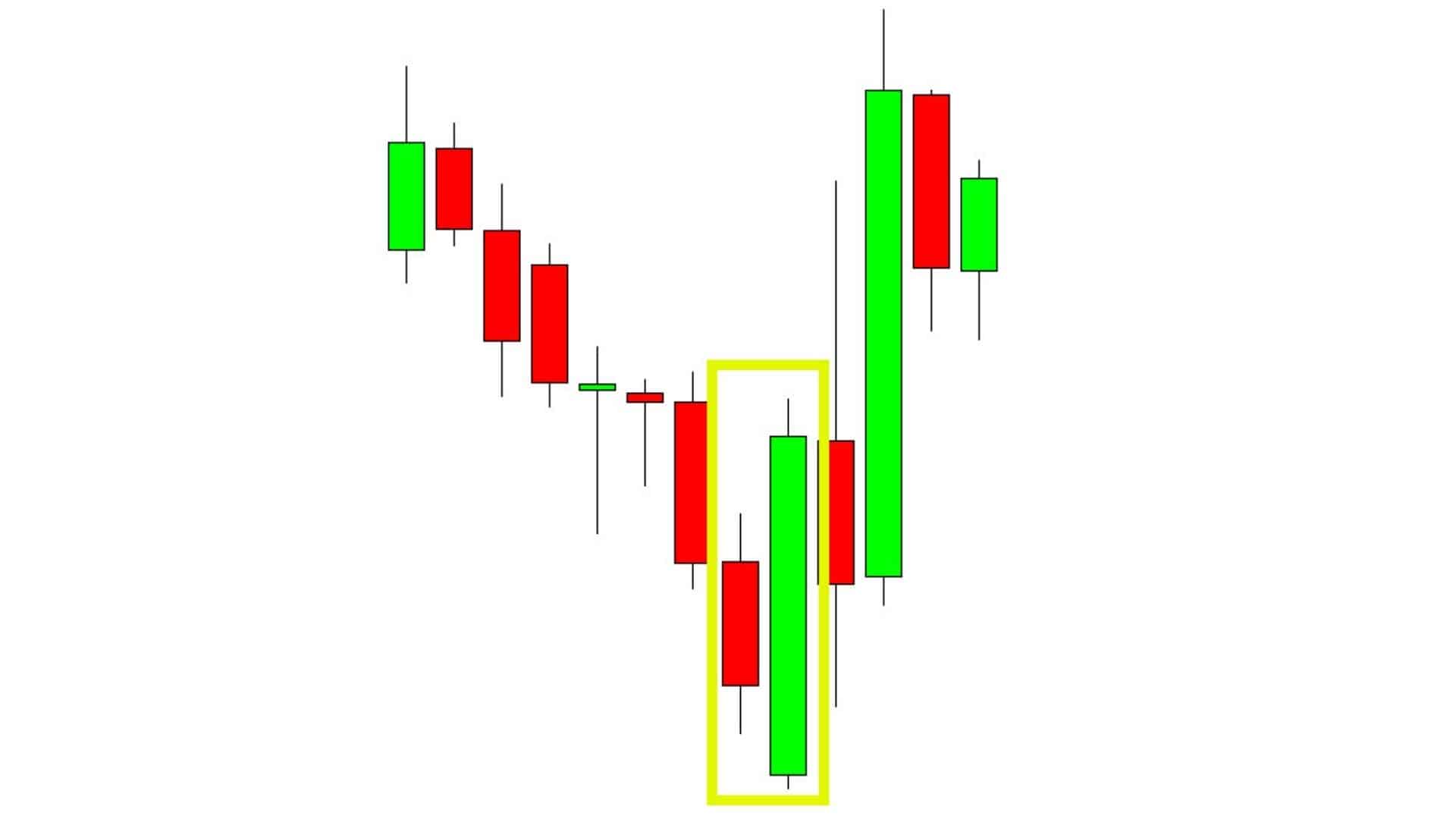

Bullish patterns may form after a market downtrend, and signal a reversal of price movement. In addition, the color of the candlestick body tells if the opening or closing price is higher. Web candlestick patterns are technical trading tools that have been used for centuries to predict price direction. Learn how these patterns work and which 8 ones you should know. They are an indicator for traders to consider opening a long position to profit from any upward trajectory.

Web candlestick patterns are technical trading tools that have been used for centuries to predict price direction. Each bullish candlestick shows one day’s worth of price data: Web six bullish candlestick patterns. Web bullish candlesticks indicate entry points for long trades, and can help predict when a downtrend is about to turn around to the upside. How to set entries and risk for each; To that end, we’ll be covering the fundamentals of. Web therein lies the importance and functionality of bullish candlesticks and candlestick patterns. Learn how these patterns work and which 8 ones you should know. What these patterns look like; Here, we go over several examples of bullish. Web when viewed together over a period of time, these candlesticks form patterns that traders analyze to gauge trend reversal points, momentum, and potential future price direction. What are the criteria for confirming them; In addition, the color of the candlestick body tells if the opening or closing price is higher. The opening price, the closing price, and the high and low of the day. Web bullish candlestick patterns are a sign of the end of a downtrend.

In Addition, The Color Of The Candlestick Body Tells If The Opening Or Closing Price Is Higher.

Learn how these patterns work and which 8 ones you should know. Sure, it is doable, but it requires special training and expertise. How to set entries and risk for each; Web when viewed together over a period of time, these candlesticks form patterns that traders analyze to gauge trend reversal points, momentum, and potential future price direction.

For Each Pattern, We’ll Cover:

Web the bullish candlestick patterns consist of one or two candlesticks, which means there can be single or multiple candlesticks. We provide a list of bullish signals to help you make informed trading decisions. Trading without candlestick patterns is a lot like flying in the night with no visibility. The same formula applies to each time frame chart being viewed.

Web Therein Lies The Importance And Functionality Of Bullish Candlesticks And Candlestick Patterns.

What are the criteria for confirming them; Each bullish candlestick shows one day’s worth of price data: To that end, we’ll be covering the fundamentals of. Here, we go over several examples of bullish.

What These Patterns Look Like;

The opening price, the closing price, and the high and low of the day. They are an indicator for traders to consider opening a long position to profit from any upward trajectory. There are dozens of different candlestick patterns with intuitive, descriptive. There are many bullish candlestick patterns, but in this post, we will learn only 7 powerful bullish candlestick patterns, which work great for me in my trading.