Web what is a bearish candlestick pattern? Comprising two consecutive candles, the. These patterns often indicate that sellers are in control, and. Web bearish candlestick patterns are either a single or combination of candlesticks that usually point to lower price movements in a stock. Let’s break down the basics:

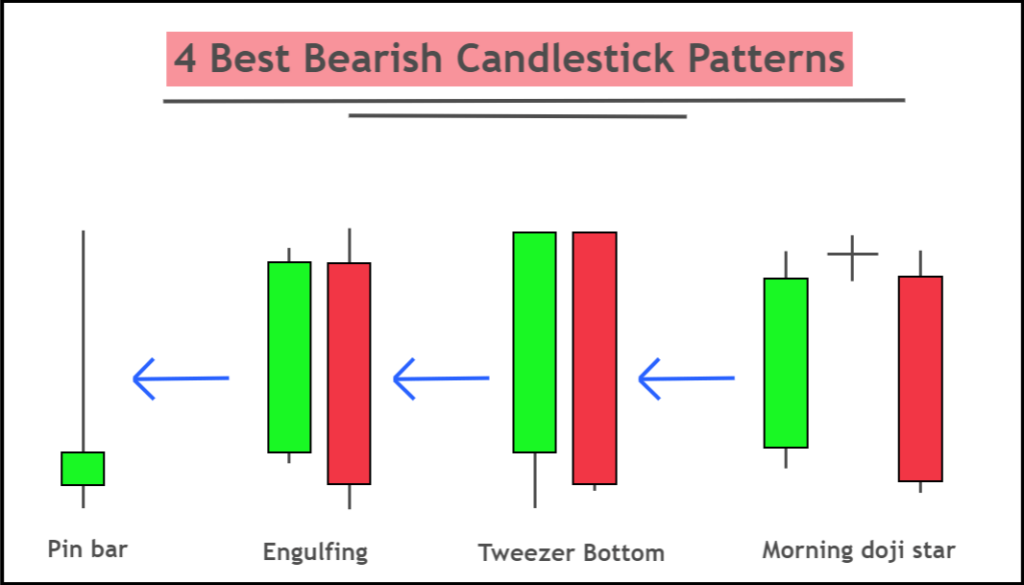

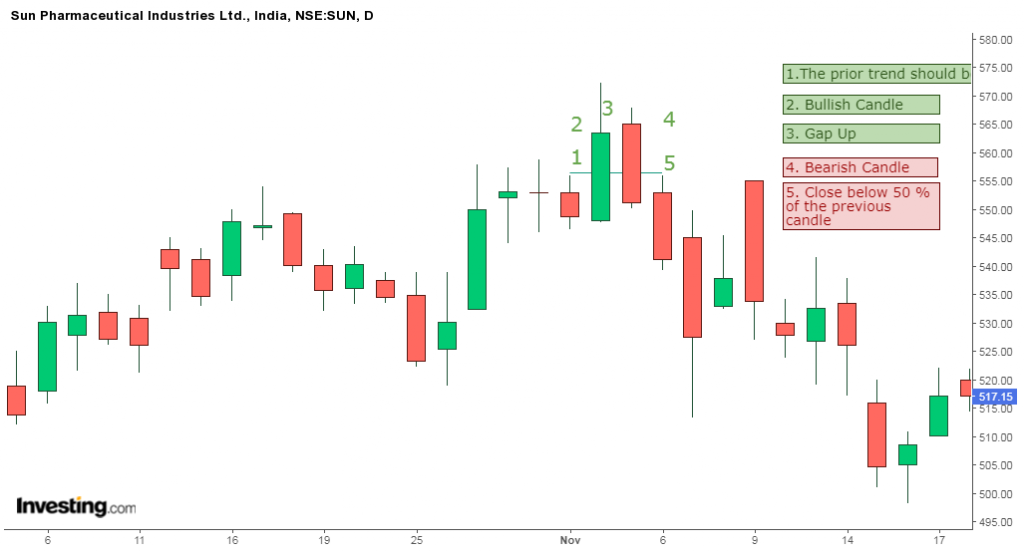

Sure, it is doable, but it requires special training and. A bearish candlestick pattern is a visual representation of price movement on a trading chart that suggests a potential. Web bearish candlestick patterns are chart formations that signal a potential downtrend or reversal in the market. Let’s break down the basics: At no.1 we are going with a bearish reversal pattern very useful and easy to.

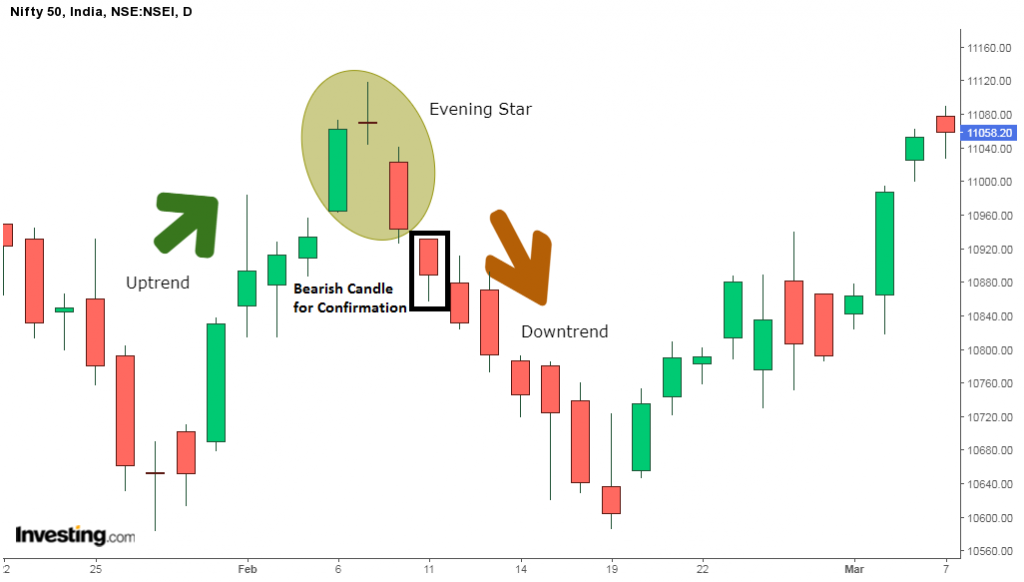

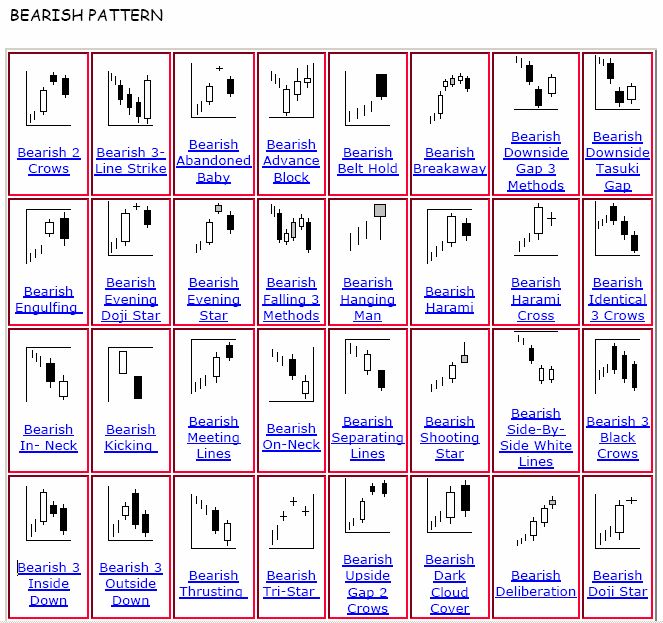

Web bearish candlestick patterns are chart formations that signal a potential downtrend or reversal in the market. Web just like many bullish candlestick patterns, bearish candlestick patterns can also be categorised into patterns indicating reversal and continuation. How to use bearish candlestick patterns to buy/sell stocks. In this article, we are. Web in technical analysis, the bearish engulfing pattern is a chart pattern that can signal a reversal in an upward price trend.

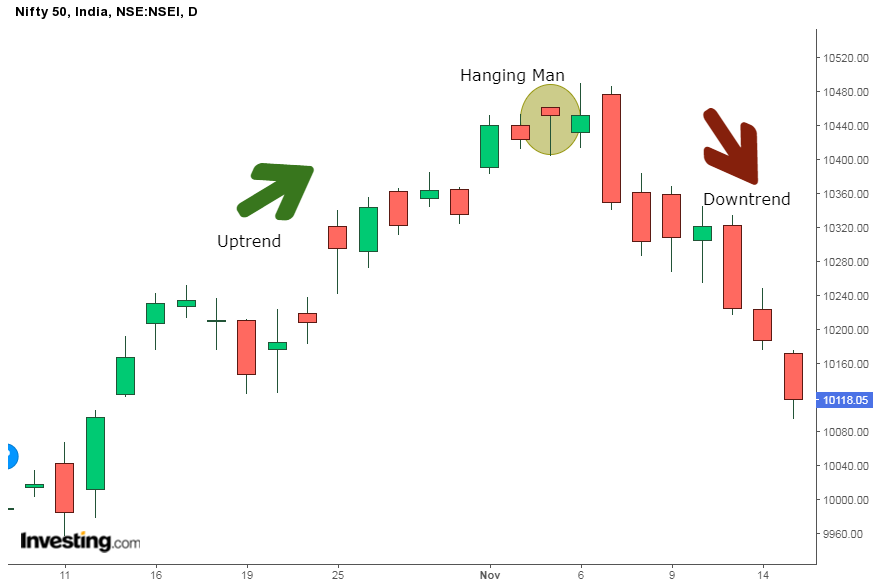

Web both bullish and bearish flags indicate that the prevailing power is strong to form a trend. Web candlestick patterns are made up of individual “candles,” each showing the price movement for a certain time period. Heavy pessimism about the market price often causes traders to close their. A bearish candlestick pattern visually represents a market sentiment that suggests a potential price decline. How to use bearish candlestick patterns to buy/sell stocks. In this article, we are. Web bearish candles show that the price of a stock is going down. Web in technical analysis, the bearish engulfing pattern is a chart pattern that can signal a reversal in an upward price trend. At some point, the opposing power gains enough control to try and push the price in the. Bullish candles show that the price of a stock is. Bullish, bearish, reversal, continuation and indecision with examples and explanation. Web bearish candlestick patterns are either a single or a combination of candlesticks that usually point to lower price movements in a stock. These patterns are formed by the. The bearish abandoned baby is a powerful reversal pattern characterized by a gap down after an. Web bearish candlestick patterns usually form after an uptrend, and signal a point of resistance.

Web Discover What A Bearish Candlestick Patterns Is, Examples, Understand Technical Analysis, Interpreting Charts And Identity Market Trends.

Web candlestick patterns are made up of individual “candles,” each showing the price movement for a certain time period. Comprising two consecutive candles, the. Web just like many bullish candlestick patterns, bearish candlestick patterns can also be categorised into patterns indicating reversal and continuation. Web what are bearish candlestick patterns.

Web Bearish Candlestick Patterns Typically Tell Us An Exhaustion Story — Where Bulls Are Giving Up And Bears Are Taking Over.

Bullish candles show that the price of a stock is. Sure, it is doable, but it requires special training and. Web bearish candlestick patterns usually form after an uptrend, and signal a point of resistance. Watching a candlestick pattern form can be time consuming and.

At No.1 We Are Going With A Bearish Reversal Pattern Very Useful And Easy To.

Web both bullish and bearish flags indicate that the prevailing power is strong to form a trend. Web a few common bearish candlestick patterns include the bearish engulfing pattern, the evening star, and the shooting star. Web 📚 a gravestone doji is a bearish pattern that suggests a reversal followed by a downtrend in the price action. Web in candlestick charting, bearish candlestick patterns are specific formations of one or more candlesticks on a price chart that suggest a higher likelihood of a downward.

A Bearish Candlestick Pattern Visually Represents A Market Sentiment That Suggests A Potential Price Decline.

They are typically red or black on stock charts. A bearish candlestick pattern is a visual representation of price movement on a trading chart that suggests a potential. At some point, the opposing power gains enough control to try and push the price in the. Let’s break down the basics: